High Probability Trading Ahead – Stay Long – QQQ and IWM Poised To Run

Posted 9:30 AM ET - Earnings season is about to kick off and trade war concerns have temporarily subsided. Asset Managers will focus on the here and now and profits will be hard to resist. Under allocated investors will be scrambling to get long if the market breaks out (fear of missing out). The NASDAQ 100 and the Russell 2000 are on the verge of doing so today.

Banks will dominate the scene and they have been beaten down. The stress tests are behind them and we are likely to increase dividends and share buybacks when they post results. Financials have room to bounce and this sector should provide solid footing for the S&P 500. Economic conditions are strong and the Fed plans to raise interest rates. Both conditions are good for banks.

Earnings season will crank up next week. Analysts are expecting a 21% increase in profits year-over-year for the S&P 500. Those are incredible numbers and they are on par with Q1 results. The market has not advanced during the last quarter and stocks have grown into their valuations. At a reasonable forward P/E of 16 there is room to run.

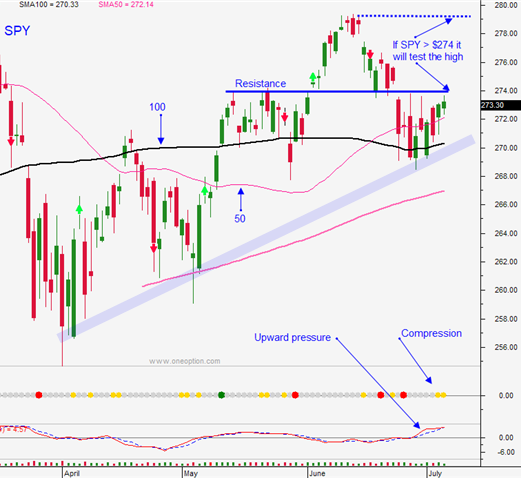

Traders are numb to tariffs. The first-round has been initiated by the US and our trading partners have retaliated. If the SPY gets a one month reprieve from tariff tit-for-tat retaliations it will make a new high.

The Fed is hawkish, but the market has shouldered the likelihood of higher rates. Economic growth is strong and inflation is moderate. The only Fed surprise at this time would be more dovish tone (market friendly).

Swing traders are long IWM calls at the $166 level. Place your stop at $167 on a closing basis. I expect to see a steady grind higher for the next two weeks.

Day traders should look for opportunities to get long. Basic materials and financials are bouncing and I will be watching those two sectors. I will also be watching the QQQ and IWM to see if they can breakout to a new all-time high. If they do I will be more aggressive with my longs.

This is a high probability trading environment. Size up and get aggressive with longs if we are above the first hour high and if major indices are breaking through horizontal resistance.

.

.

Daily Bulletin Continues...