Market Poised To Breakout – Economic Growth and Profits Are the Focus

Posted 9:30 AM ET - The market wants to rally. Chinese tariffs were imposed on steel and aluminum today and China retaliated as promised. The FOMC minutes were very hawkish yesterday and the Fed wants to tighten aggressively. The S&P 500 rallied more than 20 points in the midst of this negative news. Earnings season starts next week and profits are in focus.

One of Trump’s platforms was steel and aluminum tariffs so the first-round of action was expected. The next round could lead to a trade war. Investors believe that Trump will back off ahead of the November mid-term elections. Trump said that deals are coming soon - one agreement would spark enough buying to get the S&P 500 to the all-time high. I sense that Asset Managers are under allocated and that they will be scrambling to catch up if the market breaks out.

The Fed sees strong employment and solid economic growth. They will hike rates one more time this year and four rate hikes are projected in 2019. The market will shoulder tightening as long as economic growth is strong and inflation is moderate (2%).

ISM manufacturing was very strong this week (60.2) and so was ISM services (59.1). ADP showed that 177,000 new jobs were created in the private sector during the month of June. This morning the jobs report posted a big gain of 213,000 new jobs and wage inflation was perfect at 2%. The market liked the news.

Earnings season starts next week and the action will really crank up in the middle of the month. Strong profits are expected and the market has not rallied during the last quarter. Stocks are growing into their valuations and the market is not rich at a forward P/E of 16. Traders will focus on cash in hand and the market will move higher if the tit-for-tat tariffs take a pause.

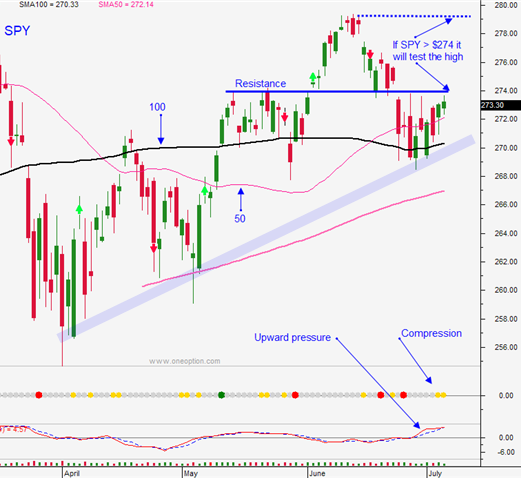

Swing traders are long IWM calls from $166 and the index is above that now. If the SPY can get through $274 and we will have a horizontal breakout and we could challenge $280.

Day traders should look for an opportunity to get long early. If the market reverses quickly after an early drop it will have another strong day. Buyers have been tenuous on Fridays because trade war news, over the weekend and it has been heated lately. I believe that the SPY could Test $274 today. Use the first hour range as your guide.

Daily Bulletin Continues...