Turkish Crisis Can Be Resolved – Market Will Tread Water – Buy Dips

Posted 9:30 AM ET - Last week the S&P 500 and NASDAQ 100 challenged the all-time high. The market lacked a catalyst and the upward momentum stalled when the indices did not breakout. Selling Thursday afternoon spilled over Friday and global markets are soft this morning. The news is light and the upward momentum is gone. Look for choppy trading in a tight range through Labor Day.

Credit is always the greatest threat to any market rally. Turkey's currency has been in a freefall and investors are worried about contagion. The US is imposing strict sanctions against Turkey until they release a wrongfully imprisoned American. This crisis can be quickly resolved, but Turkey's leadership is defiant.

North Korea will have another summit with South Korea and that is good.

Iran is threatening to shut down the Strait of Hormuz if US economic sanctions are imposed in November. The rhetoric between the two nations is heated and this could lead to conflict.

Trade talks with China are in limbo and the negotiations have stopped. The trade numbers from China were much better than expected last week and this has temporarily calmed nerves. I expect Trump to push for trade negotiations ahead of the November elections. If the tariffs go into effect companies will start warning and the market will drop. That scenario would not be good for Republicans in November.

The EU is trying to forge a trade agreement with the US and zero tariffs are the goal. This will be a drawn out process and a trade war with Europe is no longer an immediate market threat. Mexico is also anxious to strike a deal and so is Japan.

Corporate earnings have been excellent and earnings season is winding down. Valuations are reasonable and that is keeping buyers engaged.

The Fed will hike rates in September and the market is comfortable with this round of tightening since economic growth is strong and inflation is moderate.

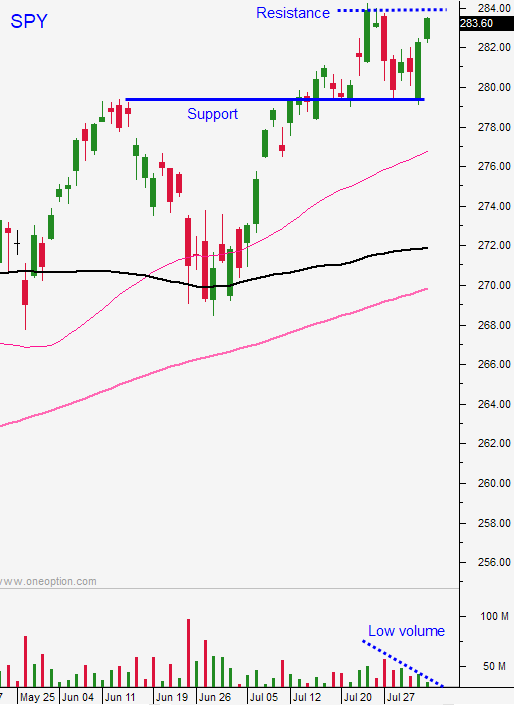

Swing traders are long a half position of SPY. We will hold without a stop and we will buy the second half at SPY $280. We want to buy dips.

Day traders should expect tight daily ranges and choppy trading. If the market is above the first hour high, trade from the long side. If the market is below the first hour low, favor the short side. Set passive targets and reduce your trade count. I have also reduced my trading size. I consider this a low probability environment.

The summer doldrums have set in. The volume has been anemic and that will continue for a few more weeks.

.

.

Daily Bulletin Continues...