Buy This Market Dip – Use This Level To Add To Your SPY Position

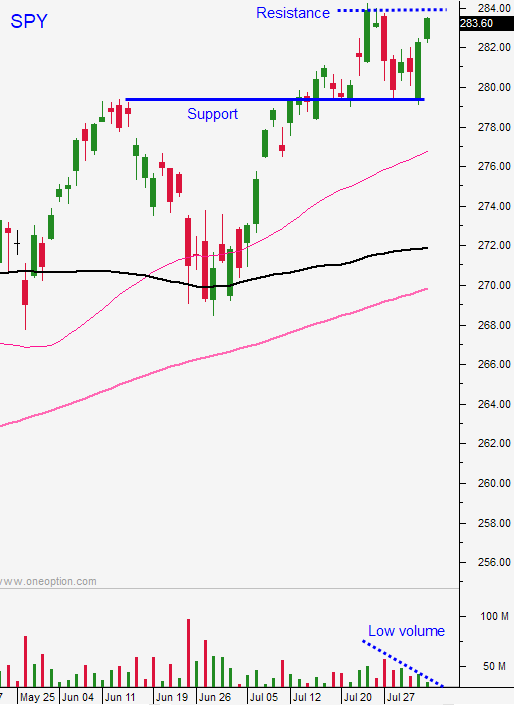

Posted 9:00 AM ET - Yesterday the S&P 500 was less than 10 points away from an all-time high. Buyers tried to challenge resistance throughout the day but the volume was light and the market lacked a catalyst. Momentum alone is not likely to push us through resistance and all sectors need to participate. Financials and energy were soft throughout the day. Sellers emerged in the last hour of trading and that pressure is spilling over this morning.

The issues that have been present for weeks are getting attention overnight. Turkish credit, Iranian sanctions, Chinese tariffs, a hawkish Fed and a possible government shutdown in September are weighing on the market. Politicians are away and investors are nervous when there is no one "minding the shop".

Credit is always the biggest concern and Turkey (EU member) is on the ropes. Two months ago Italy was the concern.

Strong earnings and excellent guidance will keep a bid to the market. Tariff deadlines can be postponed until the mid-term elections and that would delay earnings warnings. At a forward PE of 16, the market is reasonably valued.

A government shutdown is unlikely and so is a trade war with China ahead of the mid-term elections. Trump needs to preserve his rise in the polls for Republicans to hold the House and the Senate. He needs to avoid actions that would spark selling.

I've mentioned in my comments that the gains from this light volume rally can quickly be stripped away. Support will be tested this morning and the market will bottom in the next few days. We will try to buy this dip. Swing traders should buy half a position of SPY at $280. The market pullbacks have been brief and shallow since May and traders have become numb to the political crosswinds. Corporate profits are the driver and investors are hoping that a trade war will be avoided.

Day traders should look for steady selling early in the day. Use the first hour range as your guide. Nothing has changed overnight and I am more inclined to trade from the long side today. The price action the next few weeks will be filled with "noise". Random moves and tight daily ranges will be the norm. Today we will have a decent move early in the day and there should be some opportunities to day trade.

Keep your size small and reduce your trade count.

.

.

Daily Bulletin Continues...