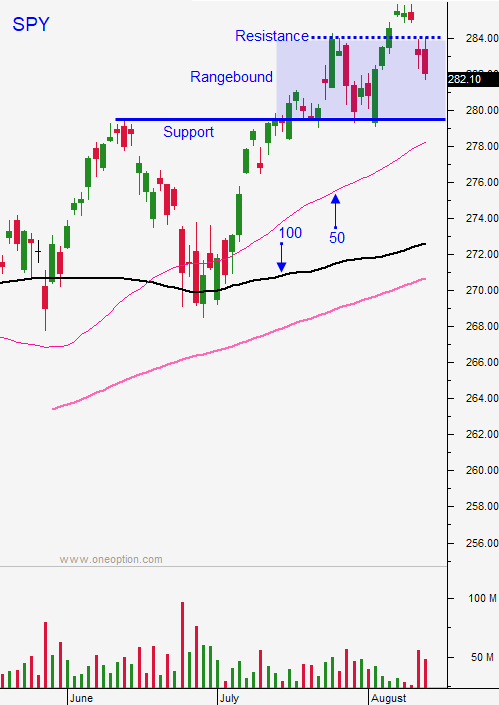

Buy More SPY If It Hits This Level – Market Should Find Support Today

Posted 9:15 AM ET - Yesterday the market opened on a positive note and it quickly soured. When stocks were not able to advance buyers pulled bids and a reversal was underway. Once the momentum was set there was no turning back. Credit concerns in Turkey were the problem du jour. The price action the next few weeks will be "noisy".

The economic news is light (retail sales, empire manufacturing and industrial production) and 95% of the S&P 500 has reported earnings. Politicians and traders are taking time off and the volume is anemic.

Turkey is likely to release a wrongfully imprisoned American and when it does so their currency will rebound (bullish). North Korea plans to meet with South Korea (bullish) and Iran is threatening to shut down the Strait of Hormuz (bearish).

A trade deal with China is in limbo (bearish), but the US is negotiating with Europe, Japan and Mexico (bullish).

Domestic economic growth is strong (bullish) and inflation is moderate (bullish). However, the Fed has an aggressive tightening agenda and rates will rise in September (bearish).

Stock valuations are reasonable at a forward P/E of 16 (bullish), but Trump is threatening a government shutdown on September 30th (bearish).

As you can see the crosswinds are stiff. The market will wait for some of these issues to be resolved and it will stay in a trading range through Labor Day.

Swing traders have a half position of SPY and we will buy the other half at SPY $280. We will hold without a stop. I believe that the November elections will force Trump to soften his rhetoric with China and that a government shutdown is unlikely. The market will rally this fall and we will ride out any temporary speed bumps.

Day traders should be leery of the opening rally. The downside will be tested early. If the selling is contained we should see a grind higher. QQQ has been strong relative to SPY so focus on tech. Use the first hour range as your guide. Keep your size small and reduce your trade count. Set passive targets knowing that this is a choppy environment. Overseas markets were stable so I believe the early rally will hold today.

Retailers will post results and in general they should be good.

.

.

Daily Bulletin Continues...