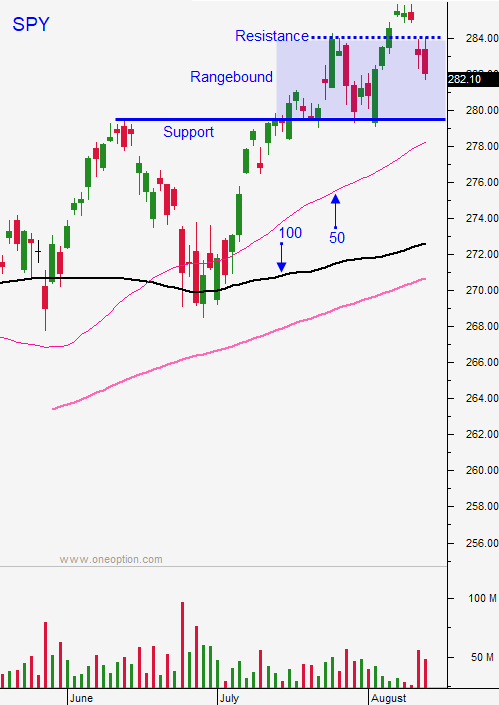

Buy This Market Dip If This Support Level Is Reached

Posted 9:00 AM ET - The news driving the market today has been around for the last few weeks. Politicians are on vacation and the investors get nervous when no one is “minding the shop”. I view this light volume price action as nothing more than "noise". This dip will present a buying opportunity and I plan to add at SPY $280.

Trade talks with Mexico seem to be going well and a possible deal could be announced in the next week. Europe is also at the negotiating table and we can expect some progress in the next few weeks. China is another story. Those talks have stalled and manufacturers are looking for new suppliers and they are starting to adjust production.

Turkey is holding out. The wrongfully imprisoned pastor is still in custody and economic sanctions will be imposed. Instead of releasing him, Turkey has decided to impose tariffs on US goods. Their currency is down more than 30% in the last week and credit markets are nervous.

Economic data points have generally been good. China's industrial production and retail sales were little light, but nothing to worry about… yet.

Domestic economic growth is very steady and unemployment is at its lowest level in decades.

All but 5% of the S&P 500 has reported and profits grew 25% year-over-year. More than 80% of companies beat expectations. Valuations are reasonable at a forward P/E of 16 and this is keeping buyers engaged.

The tug-of-war between buyers and sellers continues. Trade deals would spark a breakout.

Swing traders are long SPY (half position) and they should add at $280 ( half position). We will hold without a stop. Trump needs to finalize some deals ahead of the November elections to avoid a market decline. Republicans will try to retain control of the House and the Senate and a market rally to new all-time highs would help their cause. I believe that deals are coming and that we will not see a government shut down.

Day traders need to let the market come in. Look for support at QQQ $178 and SPY $280. Global markets were soft overnight and the early selling could gain traction. Banks are down on credit concerns and energy is down on an oil inventory build. These two sectors will weigh on the market today.

Look for early selling followed by a tight trading range. The S&P 500 was in a 3 point range most of Tuesday. We are likely to see a small bounce into the close and I expect the above-referenced support levels to hold. This choppy price action will continue through Labor Day.

.

.

Daily Bulletin Continues...