Day Traders Short the Market At This Level – Swing Traders Stay In Cash

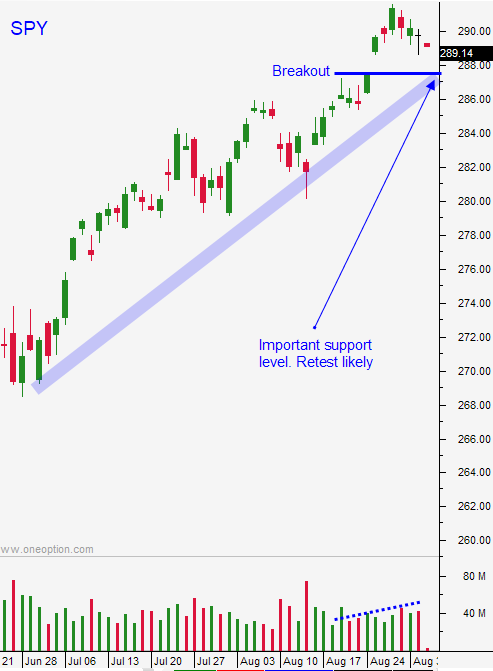

Posted 9:30 AM ET - The market is waiting for news that could push it in either direction. The S&P 500 is clinging to the breakout from two weeks ago and the selling pressure could accelerate if it is breached. The NASDAQ 100 is already below the breakout. I don't believe the market will have a meaningful rally until we see a few days of hard selling.

Fantastic earnings and strong domestic economic growth are keeping buyers engaged, but they want to buy dips. A signed NAFTA agreement would be market friendly and the old agreement expires in 30 days so officials are scrambling to get a deal done. Negotiations in Europe are also moving forward. Trump said that he won't shut the government down and Congress is close to finalizing a budget. The PBOC has been easing and we could see strong numbers from China this Friday. These are the positive influences.

Emerging market credit concerns (Italy, Argentina, Turkey, Pakistan, Russia...) are the biggest market threat. Conditions are stable, but fragile.

Wages increased .4% in August and inflation could keep the Fed in tightening mode. The FOMC will hike rates on September 26th and I'm expecting a hawkish statement.

Trade talks with China are breaking down and both countries are engaged in a tit-for-tat tariff battle. Xi wants Democrats to take the House and Senate in November. They would halt Trump's agenda. I don't believe a trade deal with China will happen before the election.

Iran and Syria are military "hot spots" and the chances of conflict are escalating.

The negatives outweigh the positives so swing traders should be on the sidelines. We are not going to short the market when it is near an all-time high and when it is in a nine year up trend. Picking "tops" is a great way to lose all of your money. We need to be patient and we need to wait for a pullback. I don't believe the market will rally until we see a heavy dose of selling. That downward pressure will reveal the strength of the bid and we will scoop stocks once support is established.

There is also a hidden danger for swing traders who want to short this market. As I mentioned above, there are positive influences that could materialize. If you are short and we get bullish news, the market will jump. Instead of looking for buying opportunities, you will be trying to mitigate your losses on short positions. Don't get hit by this "double whammy". Be patient and wait for that drop.

Day traders can short the market because they have their finger on the pulse. Conditions are changing rapidly and you have to be ready to pivot at a moment’s notice. I have been looking for opportunities to get short and I believe the market could close below SPY $287 today. Use that level as your guide and look for stocks that have relative weakness.

Swing traders should stay in cash and day traders should play the short side.

.

.

Daily Bulletin Continues...