No Meaningful Market Rally Until We Have A Few Days of Heavy Selling

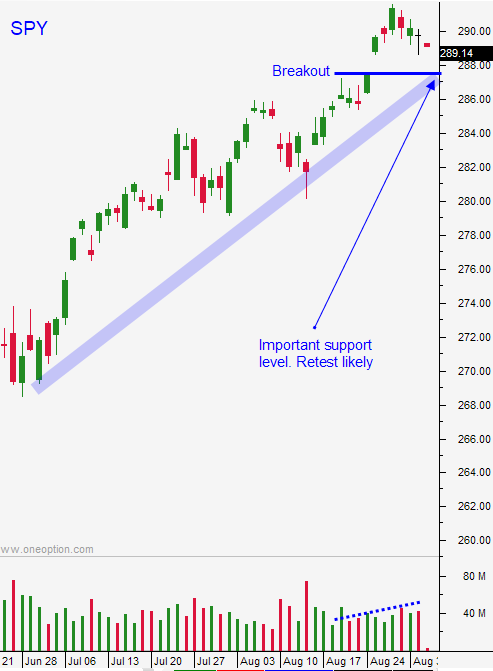

Posted 9:30 AM ET - Last week the QQQ and the SPY tested their respective breakouts. QQQ failed to hold that level and tech stocks remained weak. After testing $287 twice, the SPY was able to maintain the breakout and that is an important level to watch. There are many speed bumps ahead and I believe the market won't have a meaningful rally until we see a few days of heavy selling.

Chinese trade negotiations are not going well. Trump plans to impose tariffs on an additional $200 billion worth of goods. He is also pushing for sanctions against companies that steal intellectual property. China plans to retaliate.

China's exports were in line and imports grew 20%. Recent monetary injections by the PBOC could stimulate economic growth in the short run. Industrial production and retail sales will be posted overnight and they could be strong.

Trade negotiations with Canada have accelerated and NAFTA needs to be finalized in the next 30 days or it will expire. From what I'm reading the negotiations are progressing.

Emerging market credit conditions are fragile (Italy, Argentina, Turkey, Pakistan and others). Credit is always the biggest threat to the market and I am watching these yields closely.

Political tensions in the Middle East will escalate. Sanctions against Iran will spark naval exercises in the Strait of Hormuz. Rumor has it that Assad is planning to use chemical weapons against his people. The US is prepared to retaliate. The last airstrike was successful, but the risks are very high (civilian casualties and the possibility of hitting Russian military installments).

Domestic economic growth is strong. The Unemployment Report showed that 201,000 new jobs were created during the month of August. Wages rose .4% and that was "hot". That will put upward pressure on prices and the Fed will have to keep its foot on the brake. One Fed official said that tightening could last much longer than expected. Other Fed officials are considering higher bank reserve requirements to cool down economic growth. The FOMC will hike rates on September 26th and it is unlikely that the word "accommodative" will be changed. I believe the statement will be relatively hawkish.

Apple will release a new product this week. The stock tends to rally into the news and drop afterwards. AAPL will not be spared by Chinese tariffs and the combination of both events could pressure the stock.

Trump said that he will not push for a government shutdown. He knows this should be unpopular and this would hurt Republicans during the November elections.

Swing traders are on the sidelines waiting for a nice drop. We need clarity and the issues I've mentioned will keep buyers at bay. Asset Managers are not worried that they will miss a year-end rally. If we get a nice market drop we will be ready to buy.

Day traders should look for opportunities on the short side. I don't trust this opening market rally and I will be trying to short stocks with relative weakness near the open. A reversal could gain momentum and SPY $287 is still within striking distance. That is a level we need to watch carefully. If it is breached we could see additional selling. There are plenty of landmines and very few upside catalysts at this juncture.

Swing traders should keep their powder dry and day traders should look for shorting opportunities.

.

.

Daily Bulletin Continues...