Market Breakout Has Been Tested and Confirmed – Now We Need Good News

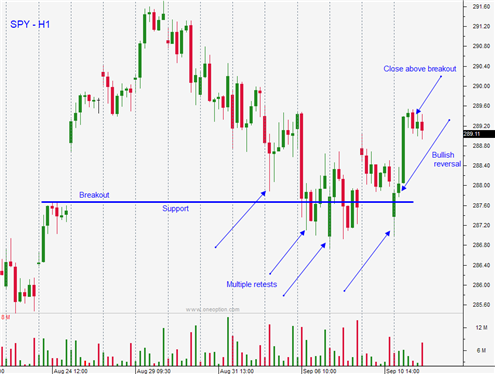

Posted 9:00 AM ET - The S&P 500 is compressing above the breakout from two weeks ago. It has been tested three times in the last week and support is holding. This is a bullish sign and the NASDAQ 100 rallied above its breakout yesterday. The bid is strong, but there is no catalyst to push us through. Some of the dark clouds need to part.

The overnight news was light. Apple will release its new iPhone and that is typically a "sell the news" event. The stock has run up ahead of the announcement.

Trade negotiations between the US and China are strained. Threats of new tariffs are constant and China is cozying up to some of our adversaries (North Korea, Russia and Iran). I don't believe we will see a trade deal before the November elections.

NAFTA will expire in less than a month and trade officials are scrambling to find middle ground with Canada. These talks seem to be progressing.

Congress is close to finalizing a budget and the threat of a government shutdown is small.

The Fed will hike rates in two weeks and the statement will be hawkish. Wage inflation will force them to keep their foot on the brake.

Domestic economic growth has been strong and we should see good numbers from China on Friday (industrial production and retail sales).

Iranian sanctions will be imposed in November and we can expect naval exercises in the Strait of Hormuz. The conflict in Syria is escalating and intelligence agencies suggest that Assad could use poison gas against his people. If this happens the US will retaliate with an air strike. This is a very risky proposition because of civilian casualties and the possibility of hitting Russian military installments.

Emerging market credit conditions are stable but fragile. Higher interest rates in the US are impacting their ability to borrow money. Credit is the one thing that can spoil this rally and I am monitoring it closely.

The market opened on a sour note yesterday and buyers scooped stocks immediately. That reversal was a bullish sign and we might not get the round of selling we were hoping for. I still believe that the sidelines are the best place to be right now. We need clarity and we need market momentum before we buy calls. If the market grinds higher and challenges the high from two weeks ago we will gradually ease into bullish positions. Until then, swing traders should remain sidelined.

Day traders should focus on the long side today. The bullish reversal yesterday should pave the way for higher prices. Support at SPY $287 has been tested three times and support has been confirmed. I did trade from the short side yesterday and I was able to make good money by being in the right stocks (SERV, AMD, TXN and BZUN). Today I will look for stocks that have relative strength.

The news is light and we should see a grind higher today.

.

.

Daily Bulletin Continues...