Market Gaps Higher – Be Careful – Only Buy If This Happens

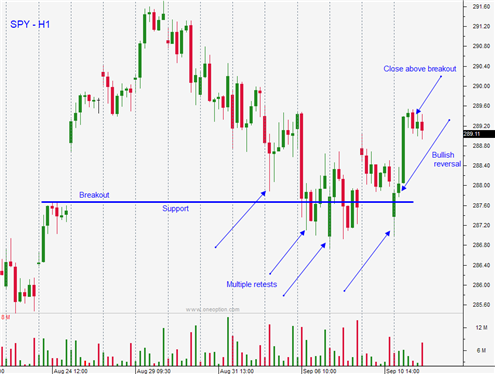

Posted 9:30 AM ET - The market broke out to a new all-time high before Labor Day and it has successfully tested that support level in the last two weeks. Prices are firming up and buyers are nibbling. If the SPY makes a new high for the day after three hours of trading we will buy. Opening gaps higher have been faded this year so we have to let the dust settle this morning.

Trump is trying to get China back to the negotiating table. Trade officials will meet and this news hit the wires yesterday. The initial reaction sparked a rally and stocks fell back just as quickly. Traders don't want talks, they want a deal. As I have been mentioning in my comments, I don’t believe a trade deal with China will happen before the November elections. At best, Trump will scale back the proposed tariffs as a sign of good faith.

NAFTA negotiations are moving forward and the Canadian Trade Minister said that progress is being made. They are hammering out some final details.

Trump said that he won't push for a government shutdown and Congress is close to passing a budget. This is positive for the market.

Intelligence reports suggest that Assad could use chemical weapons against his people and the US will retaliate. An air strike has to be precise to avoid civilian/Russian casualties and this is a risky maneuver.

Sanctions against Iran will be imposed in November and they will increase their naval activity in the Strait of Hormuz.

Credit conditions in emerging markets are fragile, but stable for the moment. Turkey’s central bank raised its prime lending rate to 24% (up from 17.5%). Argentina, Pakistan, Italy, Russia and a host of other nations are seeing yields move higher. They are having a difficult time borrowing money and that will be more challenging after the Fed rate hike in two weeks. I'm expecting a hawkish FOMC statement.

There are plenty of dark clouds and a lightning strike could happen at any time. Buyers seem undeterred at the moment, but that can change.

Swing traders should remain in cash for the first three hours of trading. If the market makes a new high for the day after that, buy the SPY. From a technical perspective the backdrop is good. The market had a breakout and it successfully tested support at that breakout. Now we should see follow-through buying.

Day traders should look for stocks with relative strength today. Let the early rally prove itself before getting long. Opening gaps higher have been faded this year and I don't trust this move. If the dip during the first hour is shallow and brief, buy stocks. If the market gradually starts to tick lower and it goes into negative territory, favor the short side.

The market will try to grind higher as long as trade talks continue, inflation remains moderate, credit conditions remain stable and tensions in the Middle East don't escalate. From a day trading perspective there are plenty of opportunities. From a swing trading perspective we are walking on thin ice and we need to have a stop in place. Use SPY $287 as your stop on a closing basis if we buy today.

.

.

Daily Bulletin Continues...