Buy the SPY Today If This Happens

Posted 9:30 AM ET - The S&P 500 is within a few points of the all-time high that was established two weeks ago. The breakout has been successfully tested and buyers are nibbling despite dark clouds on the horizon. Buy the SPY if the conditions below are met.

The US will resume trade talks with China, but I don't believe a deal will be negotiated before the November elections. Trump has stated that China needs a deal more than we do and today we learned that foreign investment in China is to decelerating. China's industrial production grew 6.1% and retail sales grew 9%. Both numbers were in line with expectations and results were bolstered by loose PBOC policies. Trump's agenda will hurt China and Xi will not approve a trade deal before the November elections.

Credit conditions in emerging markets (Argentina, Italy, Pakistan, Turkey, Russia, Venezuela and many others) are fragile. Higher interest rates in the US will make borrowing more difficult for these countries. Turkey raised its prime lending rate to 24% and it will be interesting to see what the ECB does to help one of its members.

Hourly wages rose .4% in August and that will keep the Fed in tightening mode. I believe the FOMC statement on September 26th will be hawkish.

Middle East tensions (Iran and Syria) are running high and conflict could breakout at any time.

All of these dark clouds are being ignored and investors are focused on corporate profits. More than 80% of companies exceeded earnings estimates and profits grew 25% in Q2 year-over-year. At a forward P/E of 17 stocks are fairly priced.

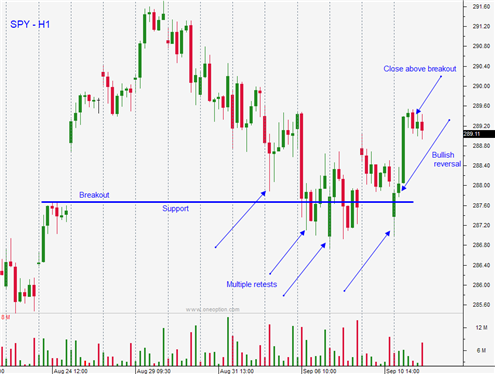

Swing traders will buy the SPY today if it can make a new high for the day after the first hour of trading. Use a stop of $289 on a closing basis. Yesterday's gap higher survived and that is a bullish sign. The bid is strong and the market is climbing a "wall of worry". Congress should pass a budget in the next two weeks and that could help the market. Canada is scrambling to forge a trade deal before NAFTA expires in a few weeks. That would also be a market friendly event.

Day traders should focus on the long side. If the market makes a new all-time high you can get more aggressive. Increase your size if the momentum starts to build. There wasn't much overnight news to fuel a rally so I'm expecting a small grind higher.

Swing traders will get long if the market starts to grind higher and we will have a stop in place. Day traders should use Option Stalker to find attractive stocks. I have been using a search that looks for heavy volume today, relative strength, liquid options and a breakout above yesterday's high. There are other great searches I am highlighting in the chat room as well.

.

.

Daily Bulletin Continues...