Resistance At the High Is Strong – My Favorite Trading Indicator Was Right

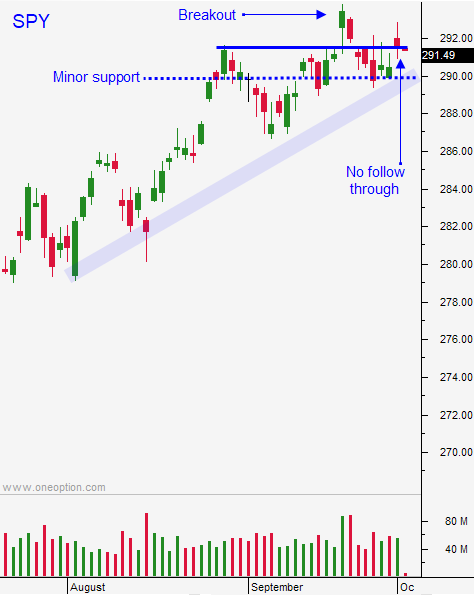

Posted 9:30 AM ET - Yesterday the market gapped up and it challenged the all-time high on the open. That pattern has been faded this year and it was faded yesterday. Stocks retreated and the S&P 500 is down 12 points this morning. As I've been mentioning in my comments there are plenty of dark clouds to keep a lid on the market.

Last week I predicted that the Fed's tone would be hawkish. Chairman Powell signaled future rate hikes in his recent speech and US treasuries are at their lowest level (highest yield) in years. I also mentioned that rising US interest rates would have a ripple effect on global rates and that is happening. This technical breach for bonds is the "problem du jour".

Rising interest rates are not a problem as long as economic growth is strong and inflation is contained. ISM manufacturing, ISM services and ADP were robust this week. Job growth is strong and ADP reported that 230,000 new jobs were created in the private sector durring the month of September. This will put upward pressure on hourly wages and an increase of .4% or higher will be problematic for the market. Wages are the biggest input expense for corporations and they will weigh on profits. Furthermore, rising wages are inflationary since manufacturers need to raise prices to maintain profits. Price hikes will lag and margins will initially contract. Inflation will keep the Fed in tightening mode. Wage increases are good in the long run, but there is an initial shock factor.

Trade agreements with Canada, Mexico, South Korea and Japan are progressing. Europe is verbally committed to a zero tariff policy for industrial goods, but negotiations will be lengthy. A full-blown trade war with China seems likely. The rhetoric is deteriorating and I mention this extensively in my comments Wednesday.

Earnings season will start the week from tomorrow when major banks (J.P. Morgan Chase, Wells Fargo and PNC) post results. At a forward P/E of 17, stocks are priced for perfection. Mega cap tech stocks (Facebook, Netflix, Google and Twitter) have been relatively weak and optimism heading into the numbers could be soft relative to prior quarters. I believe it is still too early for corporations to lower guidance based on tariffs because they have not been implemented yet. The market bid is typically strong heading into earning season and year-end. However, Asset Managers don't feel like they will miss a year-end rally. They will buy on dips, but they will not buy at the high.

I've been mentioning in my comments that strong year-end rallies occur after a nice drop in August/September. We didn't get one this year so the upward momentum is likely to be muted. The rally this year has been narrowly defined and Apple and Amazon have accounted for 30% of the gains in the S&P 500. This is not healthy and we need to see a broad-based participation.

The November elections favor the Democrats if you believe the polls. If the Republicans lose the House the market will have a difficult time reaching SPY $300 this year. If Democrats gain control of the House and Senate the market will drop. Trump's policies have been market friendly.

Italy has been making headlines because their budget deficit will reach 2.4% of GDP in 2019. This is well outside of the EU guidelines and they promise to bring this percentage down in subsequent years. Credit concerns are on the rise and there are many "hot spots" (Italy, Turkey, Pakistan, Venezuela, Russia, Argentina...). Perhaps the biggest concern is the shadow banking industry ($16 trillion) in China. It could be exposed if trade relations deteriorate. China has instructed its media not to report on declining economic activity.

Swing traders should place an intraday stop at SPY $290. That is our entry point and we will exit if it is breached. I am fairly neutral at this level and I am hopeful that we get a nice market decline. Bullish speculators are on the verge of getting flushed out and that will present an excellent buying opportunity. I would like to see the SPY at $287 or lower. Once support is established we could slingshot to $300 in the last two months of the year. If we do not get the market drop I will primarily day trade.

Day traders should use the first hour range as a guide. If we are below it, favor the short side and know that minor support is at $290. If the market is above the first hour high, favor the long side. Industrial stocks and healthcare have been strong. I just posted a video yesterday of one of my favorite indicators and we are using it to day trade.

BEST TECHNICAL INDICATOR

The wage component of the Unemployment Report will be a speed bump tomorrow if it is .4% or higher. The hurricane will weight on the jobs report and analysts are only expecting 180K new workers.

My market bias is neutral and I am waiting for a pullback.

.

.

Daily Bulletin Continues...