Market Will Challenge the All-time High Today – Use An Intraday Stop On SPY

Posted 9:30 AM ET - The market is trying to rally into earnings season and the USMCA trade deal has provided a tailwind. Japan and South Korea are trying to forge agreements as well. Italian credit concerns eased slightly overnight and the S&P 500 is up 10 points before the open.

Trade deals are important to this market rally. The EU has many members and many industries. I don't believe they will strike a deal until Trump sets a deadline. He will try to get a few more deals done before the elections and he will apply pressure to the EU in November if progress is not being made.

Trade negotiations with China are in a tailspin and a full-blown trade war should be expected. Provisions in the USMCA agreement state that the US can pull out of any trade deal if members are negotiating with non-market countries (China). This provision will be added to other trade deals and Trump is applying the "thumb screws". Technology exports to China are also being curbed to protect intellectual property rights. US naval exercises in the South China Sea have increased and arms were sold to Taiwan last week.

China will retaliate. They plan to import oil from Iran (defying US sanctions) and they are importing soybeans from South America. Xi and Putin are getting cozy and they have conducted joint military exercises. China might restrict electronic exports to the US and it controls 95% of the world’s molybdenum (rare earth) supplies. This element is used in the manufacture of electronic components like cell phones. China has also instructed its media not to report negative economic news. These are all signs that they are prepared for a long trade battle.

Italy said that it will reduce its budget deficit 2.2% in 2019 and 2% in 2020. Previously it so that it would run a 2.4% deficit for the next three years. This softer tone is calmed nerves, but the budget is well outside of EU guidelines. The news will be good for financial stocks today.

This morning ADP reported that 230,000 new jobs were created in the private sector during the month of September. This is a very robust number and it bodes well for Friday's Unemployment Report. Hourly wages will be carefully monitor and an increase of more than .3% could spark inflation fears. Amazon just announced that it will raise its minimum wage to $15 an hour. Wages are the largest expense for companies and the increase will reduce profits. Higher wages are also inflationary and it will keep the Fed in tightening mode. This could be a potential speed bump.

In the long run, higher wages are good for economic growth as long as they are demand (not inflation) driven. Consumers have more discretionary income and that fuels the growth cycle.

The focus is on earnings and domestic economic growth. Asset managers are ignoring the global backdrop for now. The P/E of the S&P 500 is trading at its highest premium relative to emerging market P/E's in over 10 years.

Earnings season needs to produce fantastic results. Any profit warnings due to higher wages or tariffs will weigh on the market. At a forward P/E of 17, stocks are priced for perfection. Seasonal strength will also attract buyers.

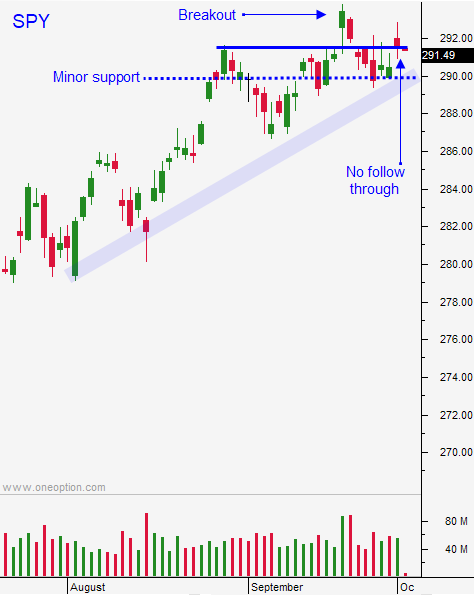

Swing traders should use an intraday stop at SPY $290. If the market breaks out we will raise our safety net.

Day traders need to tread cautiously on the open. Gaps higher have often been faded and we need to make sure that the gains hold before we start taking bullish positions. The all-time high will be challenged and it should provide some resistance. Financial stocks have lagged and they should perform well today. J.P. Morgan chase will post results a week from Friday and it tends to rally into earnings season. I will buy pullbacks in the financial sector today. If the market does not reverse in the first hour, is likely to make a new all-time high. If we get a steady grind higher you can get more aggressive with your longs.

.

.

Daily Bulletin Continues...