SPY $287 Should Hold – Wages OK – Here Are Swing Trades For Today

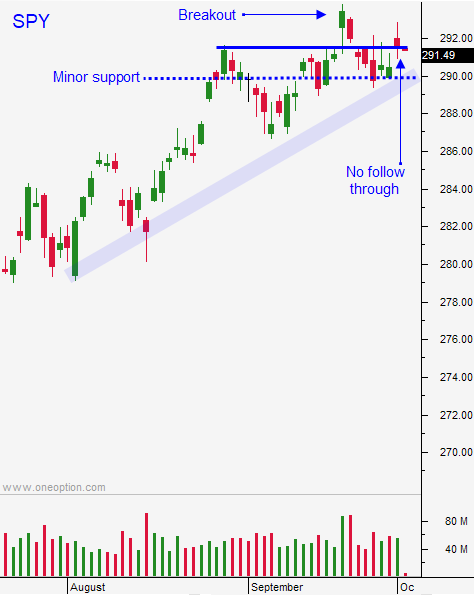

Posted 9:30 AM ET - Yesterday the market rolled over and resistance at the all-time high is firm. U.S. Treasury yields hit their highest level in years and bonds broke major horizontal support. Hawkish comments from the Fed chairman did not help. This dark storm cloud produced lightening and bullish speculators were flushed out. We scratched our SPY position and we are in cash.

Rising interest rates are not a problem as long as they are accompanied by economic growth and as long as inflation is contained. The economic data was strong this week (ISM manufacturing, ISM services and ADP). The wage component of the Unemployment Report increased .3% and that is a good reading. A number above .3% would have been problematic. According to the government, 134,000 new jobs were created during the month of September. That was "light", but the hurricane played a role. ADP processes payrolls for small and medium-size businesses and I put greater weight in their robust number (230,000 new jobs).

The trade scene has not changed much overnight. Deals with Canada, Mexico, South Korea and Japan are in the works. The EU will take time since its membership is fragmented and it's industries are diverse. Right now the EU is close to signing a Brexit deal and that is the priority.

A full-blown trade war with China should be expected. Both sides are exchanging punches and the rhetoric is deteriorating.

Earnings season will start a week from today and major banks will report. The market bid is typically strong ahead of earnings season.

Swing traders should buy the SPY if it goes above $291 at any time today. We want to make sure that this wave of selling has run its course before we get back in. Ideally, profit-taking will continue to flush bullish speculators out of the market and we will have a better entry point at lower levels next week. Bullish sentiment was extremely high and some of the air has been let out of the balloon. I've been mentioning in my comments that there are plenty of headwinds and that a drop was likely.

Day traders should use the first hour range as a guide today. If you did this yesterday, you made a killing on the short side. I believe that the market will find its footing today. We tested support at SPY $297 and we bounced. The wage component of the jobs report was a potential speed bump and a .3% increase is benign. Industrials and healthcare have been strong relative to the market and technology has been weak.

I recorded another video yesterday to show you how I use my indicator to find day trades. We shorted the S&P 500 yesterday and we bought the NASDAQ 100 and the last hour of trading based on the signals. Click this link to watch it.

DAY TRADE EMINI FUTURES WITH MY FAVORITE INDICATOR

This morning I recorded a video on how I use it to swing trade. These stocks are setting up right now. Click this link to watch it.

GREAT SWING TRADES FOR TODAY USING MY FAVORITE INDICATOR

.

Daily Bulletin Continues...