Market Bounce Is Coming – Nothing Calms Nerves Like Profits

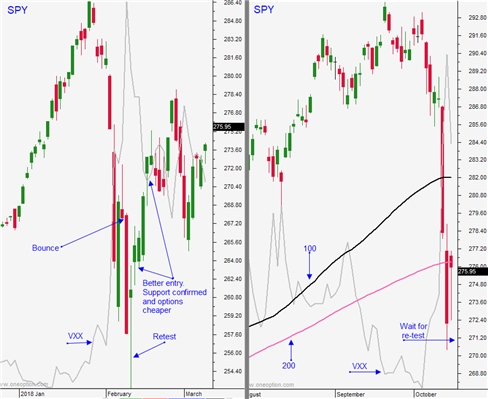

Posted 9:30 AM ET - Yesterday the market dropped in the last hour of trading and there are still some nervous jitters that need to be worked off. The S&P 500 is up 18 points before the open and it will challenge the 200-day moving average. With each passing day the bid will grow and we will be closer to a nice bounce. We bought the SPY yesterday at $276 and we are holding without a stop.

Trade deals are at a standstill. US relations with China are deteriorating and it is not certain if Trump and Xi will meet during the G20 meeting on November 29th. Brexit negotiations stalled temporarily, but both sides are committed to getting a deal done. US negotiations with South Korea and Japan are ongoing.

Interest rates are rising around the globe and a rate hike in December is likely. Italy has approved its budget and the deficit will be 2.4% of GDP in 2019. That is much higher than the EU would like. Rising rates in the US are fueling emerging market yields and credit concerns are increasing.

Domestic economic growth is strong and inflation is moderate (CPI, PPI and hourly wages were benign). As long as these two factors are intact the market will shoulder higher yields.

The November elections favor a neutral market reaction (if you trust the odds makers). Republicans are likely to increase their Senate seats and Democrats are likely to win the House.

Earnings season has started and IBM, LRCX and NFLX will post after the close today. Analysts are expecting S&P 500 earnings of $179 in 2019 and a forward P/E of 15.5 is reasonable. Nothing calms nerves like profits.

Swing traders are long the SPY at $276. Our first target is the 100-day moving average (SPY $282). We will look to take profits around that level. I am still expecting another aftershock so we need to take profits on this bounce. The second bounce will be even better. Option implied volatilities will collapse and you can buy calls on the second bounce.

Day traders should be leery of the opening gap higher. Make sure the gains hold and use SPY $276.30 as your guide. That is the 200-day moving average and we need to break above it. If we do, you can get aggressive with your longs. If we close above it, consider holding some of your long positions overnight.

Tech stocks have been badly beaten down and I believe the earnings tonight will attract buyers. Get long and use the 200-day moving average as your guide.

.

.

Daily Bulletin Continues...