Buy the SPY If This Happens – Market Will Retest the Low

Posted 9:30 AM ET - The market hit the air pocket we've been waiting for and the NASDAQ 100 is down 10% from its high. The S&P 500 has dropped about 8.5% so it is close to a correction as well. Nasty drops like this typically have aftershocks and you can see that in today’s chart. Earnings season has started and the results should be excellent.

There isn't any news on trade negotiations and I'm not expecting any before the elections. Our relationship with China is strained, but it looks like Trump and Xi will meet at the end of November during the G20 meeting. Negotiations with Japan and South Korea are ongoing.

Brexit negotiations took a step backwards this weekend and European markets hit a 22-month low. US trade negotiations will not be on the radar until a deal with England has been approved.

Global interest rates are on the rise and that spooked investors. Emerging market yields could be problematic and we need to watch credit markets. I don't think this will be an issue in 2018, but it could be in 2019.

Major banks posted results on Friday. Consumer lending is extremely strong and higher interest rates have improved profit margins. Watch the financial sector. We won’t get much of a market bounce without financials. Tech stocks performed well on Friday and buyers are nibbling ahead of mega-cap tech earnings. Netflix will post Tuesday after the close.

Domestic economic growth is strong, but we are seeing some signs of weakness overseas.

The betting lines suggest that Democrats have a 65% chance of winning the house and Republicans have a 75% chance of retaining the Senate. Trump's policies have been market friendly and Democrats will do everything in their power to slow his agenda. The tax bill has been passed and deregulation doesn't require congressional approval. If the Democrats control Congress the market will tank. If Republicans control Congress the market will challenge SPY $300. If the likely scenario plays out the market reaction will be neutral.

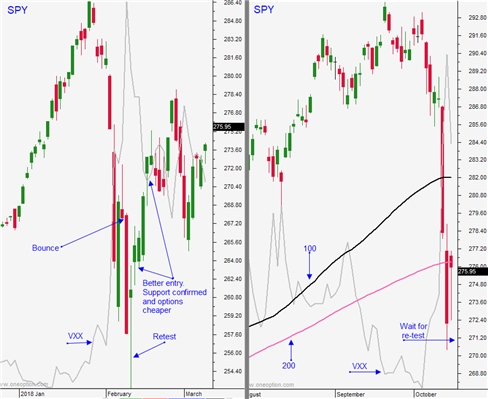

Swing traders should buy the SPY if it is above $276 any time after the first hour of trading. We will hold without a stop. Last Friday we bought the SPY at $276 and we were stopped out when the SPY dropped below $275. I am comfortable getting long at this level, but I want the nervous jitters to dissipate. The market should be able to rally to the 100-day MA before it hits resistance.

Day traders should let the market chop around early this morning. Overseas markets are soft and we are likely to probe for support. Retail sales came in at .1% (vs .6% expected) and that will also weigh on the market. If we are above the 200-day moving average you can buy aggressively and use that as a stop.

.

.

Daily Bulletin Continues...