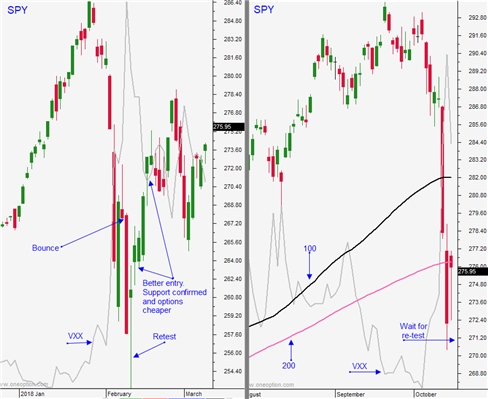

Ride Your SPY Position – Buy the Dip This Morning – Market Going Higher

Posted 9:30 AM ET - When the market bounced cleared the 200-day MA it was off to the races. Trading programs fueled the huge drop last week and they will fuel this bounce. Earnings season will attract buyers and Netflix will keep a bid under tech stocks. You should expect some aftershocks along the way. Buy dips until we reach SPY $282.

Nothing calms nerves like profits. At this level the S&P 500 is trading at a reasonable forward P/E of 15.7. The earnings calendar will really pick up next week.

The Fed is expected to hike rates in December and the FOMC minutes will be released at 2:00 PM Eastern time today. I believe the comments will be relatively hawkish.

Trade negotiations with the EU and England are progressing. Both sides want a Brexit deal. If an agreement is signed it will help European markets and in turn global markets. US negotiations with South Korea, Japan and the EU are ongoing.

A trade war with China is likely since both sides are moving farther apart. Trump wanted a deal before the November election and the Chinese used that as leverage. Trump will play "hardball" if Republicans maintain control of Congress.

China will release GDP, IP and retail sales on Friday. Their trade balance numbers were excellent a week ago so these releases should be good. That will temporarily ease trade war concerns.

The economic calendar is fairly light, but recent releases have been excellent. The JOLTS report showed that there are 7.1 million job openings, the highest reading ever.

Swing traders should place an intraday stop at SPY $278 and a target at $283. We are going to ride this bounce and take profits if we get a big run. I'm expecting this bounce to last a few weeks. If you did not get long yesterday I would buy the dip this morning.

Day traders should try to scoop the opening dip. I don't believe the selling pressure will last long. The momentum favors the upside. Be careful ahead of the FOMC minutes. That could be a small speed bump today.

We were waiting for a pullback and we got one. Earnings season will keep buyers engaged and Asset Managers don't want to miss a year-end rally. At a forward P/E of 15.7 there is room to the upside. Keep raising your stops and ride the bounce.

.

.

Daily Bulletin Continues...