Buy the Dip Today – This Overnight News Will Spark Buying Friday

Posted 9:30 AM ET - The S&P 500 is above the 200-day MA, but nervous jitters need to be worked off. I mentioned in yesterday's comments that the FOMC minutes would be hawkish. The Fed did not anticipate a 10% market decline when those comments were written. At the time, the market was making a new all-time high. If they were commenting now the tone would be softer. The Fed always softens the tone when the market corrects. Overseas markets dropped as global yields inched higher. This soft patch will soon run its course and earnings will attract buyers.

Netflix posted healthy gains yesterday after exceeding earnings estimates. That should help the tech sector. ASML and LRCX also announced healthy earnings and that will help semi-conductors. Banks also caught a bid yesterday and the market needs financials to lead the charge.

Earnings season will kick into high gear next week. Mega cap tech stocks have been beaten down and we could see some short covering. At a forward P/E of 15.7, stocks are reasonably priced.

Trade wars continue to dominate the headlines. China and the US are headed for a prolonged battle. China needed to strike a deal before the elections. If Republicans maintain control of Congress, Trump will play "hardball". He feels that China is on the ropes and their market is down 30% this year. He also feels that we have been “ripped off” for decades so he will strike a hard deal. Chinese stocks made a four-year low overnight.

Theresa May might have an alternative Brexit plan. It would be incremental and it would take longer than the current proposal. I see this as a step backwards. Both sides are trying to reach an agreement, but the headwinds are stiff. The US is waiting on the sidelines for a deal and Trump's patience with the EU is wearing thin. Politicians don't act until they are forced to. After the elections we can expect an EU deadline from Trump. Negotiations with Japan and South Korea are ongoing.

I believe the economic news tonight will soothe nerves. China will post GDP, industrial production and retail sales. The PBOC has been easing and China's trade balance numbers last week were excellent. US companies are front running potential tariffs and they are building inventories. I'm expecting solid numbers from China tonight.

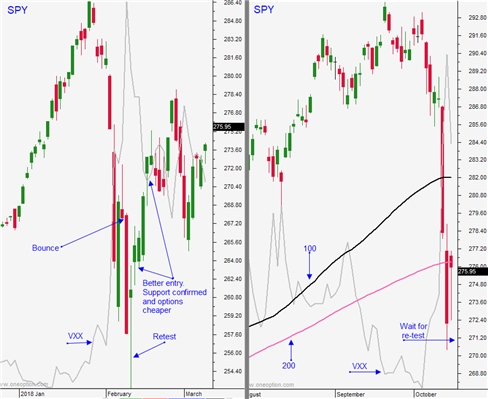

Swing traders were stopped out when the SPY traded below $278 yesterday and we took a two-point gain. Place an order to buy at $278 today. If you are not filled in the first two hours of trading, buy the SPY if it is above $280 (no stop). Profits will calm nerves and earnings season will ramp up next week. I want to be long.

Day traders should wait for support and trade from the long side. There are still plenty of nervous jitters so expect choppy trading. If the market is above the first hour high and it is above SPY $280.40 you can get more aggressive with your longs. I'm not trading from the short side. The short covering rallies are violent (like the bounce off of the low yesterday). Earnings season and seasonal strength will keep buyers engaged. If the market makes a new low for the day, step to the sidelines and wait for support. Buy dips.

.

.

Daily Bulletin Continues...