We Got the Bounce – Here’s What I Need To See Before I Buy Aggressively

Posted 9:30 AM ET - Yesterday the S&P 500 retested the 200-day moving average. That move was expected, but not so soon. In a bullish market the first bounce should have lasted a couple of weeks as buyers scooped bargains. The fact that this didn't happen suggests very heavy selling pressure. This drop will take weeks to digest and uncertainty about the mid-term elections could keep a lid on the bounce.

Netflix and Lam Research posted excellent results and both stocks retreated. This is a sign that high P/E stocks need "big beats" just to tread water. Earnings season will ramp up next week and the results should be good. At a forward P/E of 15.5 there is room to run.

Tensions in the EU are high after Italy submitted its budget proposal. Italy plans to run a huge deficit (2.4% of GDP) next year. The European Commission called its draft budget an "unprecedented" breach of EU fiscal rules. Yields are climbing and the EU could demand revisions. This has never happened before.

Credit is the one thing that can lead to prolonged market declines and there are many "hot spots" (Turkey, Venezuela, Pakistan, Italy, Argentina...).

According to the EU chief negotiator a Brexit deal is 90% done. They are still trying to figure out how to handle the Irish border. A deal would help European markets.

A trade deal with China is unlikely this year. The PBOC is injecting liquidity and regulations regarding foreign investment have been loosened. China's market is down 30% from its high this year. Fear of a prolonged trade war is taking its toll. China posted in line economic numbers this morning and we are seeing a relief rally (up 2.6%). I was expecting better results and a bigger reaction. This move was going to fuel a nice bounce in our market today and I don't think it's going to materialize. The SPY bounce off of the 200-day needed to be bigger yesterday and China’s news needed to be better.

Trump is threatening military deployment on the southern border if Mexico does not stop migrant caravans (Honduras, Guatemala and Nicaragua). He will also cut aid to those countries if they don't stop these caravans before they get organized. Trump said that this is more important than any trade deal and he is putting pressure on Mexico's recently elected president.

I believe that the November elections are the key. If Republicans control Congress the market will challenge the all-time high. If Republicans maintain the Senate and lose the House the market will muddle around. This is the most likely scenario and my bias will turn slightly bearish longer term. If Democrats control Congress the market will tank. Trumps agenda will hit a brick wall and he will be fighting constant investigations and impeachment threats.

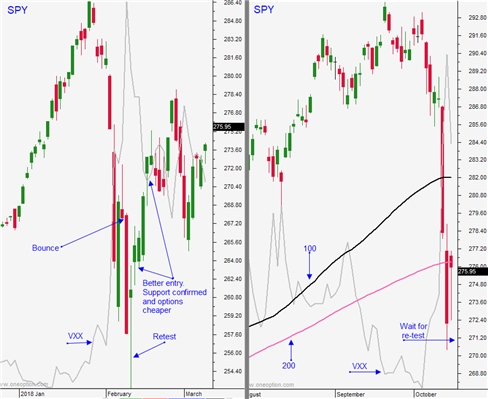

Swing traders bought the SPY at $278 yesterday. I'm comfortable being long at that level. Stocks are extremely oversold and earnings season should spark some buying ahead of the elections. We will hold without a stop and my target is the 100-day MA.

Day traders should be careful on the open. I don't trust this bounce and I believe the downside will be tested. We need to hit dip early in the day ($276.50) and we need to reverse sharply off of that low early in the day (first 2 hours). These prolonged market declines the last most all day are very bearish. They are sign of persistent selling and we need to hit a hard bottom early in the day. If we make a new low after the first hour of trading and we are below SPY $276.50 I will favor the short side. If we test that support level and immediately bounce off of it I will favor the long side and I will even carry some longs over the weekend.

Sellers should be a little more passive heading into a heavy week of earnings. Look for signs of support today.

We have been using an indicator that took me 10 years to develop in the chat room with great success. If you are an active trader you should

TAKE THE 1 WEEK TRIAL

.

.

Daily Bulletin Continues...