Take Profits On SPY Today – Trump and Xi Not Ready To Deal

Posted 9:30 AM ET - Yesterday the FOMC minutes were released and the tone was dovish. Stocks inched higher on the news, but a late day round of selling erased the gains. Trump and Xi have been sparring before the G20 meeting and that is keeping buyers at bay. The S&P 500 almost touched the 200-day moving average Thursday and that resistance should stay in place today. We are going to take profits on our SPY position and I outlined the details below.

It looks like the Fed might be ready for a pause in 2019. They have forecasted four rate hikes previously and the recent comments indicate that they have at least scaled back to three rate hikes. This is critical for the market. Stocks will shoulder tightening as long as economic growth is strong and inflation is moderate. Global activity is contracting. Asset Managers see it and they are reducing risk (selling stocks).

China posted its official PMI and it came in at 50. That means no economic expansion or contraction. This is one of the lowest readings we've seen and it could put Xi in a mood to negotiate a trade deal. Manufacturers and retailers have been loading up on inventory ahead of probable tariffs. This glut will hurt future orders and we could see a substantial contraction in China the first few months of 2019. Supply chains have moved out of China and Chinese manufacturers are offering deep discounts to keep the business. Amazon has canceled orders on products that would no longer be profitable if tariffs are raised. I have read many stories about other major companies moving their supply chains.

A Chinese trade official said that they are going to relax trade restrictions for all countries and that this is all they are willing to do. They will not cave in to US demands. This sounds like the policy they are going to adopt. Trump said that he is happy with the current path (raising tariffs) and that he is not anxious to sign a deal unless China makes major concessions. He still plans to raise tariffs in January from 10% to 25% on $250 billion worth of goods. This could be a negotiating ploy where he can postpone the increases and offer an olive branch while the terms of the deal are being drafted. This outcome would be bullish for the market.

Unfortunately, Trump will have hardliner Peter Navarro sitting at the table. This tells me that Trump is not ready to make a deal. There are many other issues (South China Sea, Taiwan, negotiations with North Korea, oil purchases from Iran and human rights) that are also causing friction. If the talks go poorly Trump could add tariffs to another $260B worth of goods.

Chinese stocks sold off yesterday – a sign that the smart money is not expecting a deal.

The US will sign a trade agreement with Canada and Mexico this weekend. It still has to get approved by each government.

Trump is threatening to shut down the government if he does not get funding for the wall. Over 70% of the budget has been approved so this would not be a broad-based shut down. Trump wants $5 billion allocated to the wall.

The conflict in the Ukraine will escalate. Trump has canceled his G20 appointment with Putin.

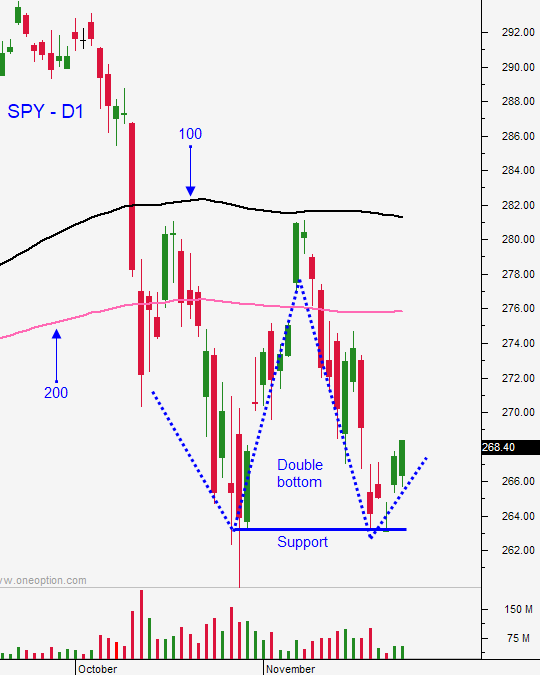

As I've been stating in my comments, the dark clouds are looming on the horizon. This is only a relief bounce and we need to make sure we don't overstay our welcome. Swing traders are long SPY at $263.50. We are going to set a target of $275.50. If we are not filled exit the position before the close. I feel that there is an equal chance that the market could rally or drop after the G20 meeting. We are close to the 200-day moving average and that was the first target. In this fickle market it is critical to take profits when you have them. If the market reaction is favorable we can decide if we want to get back in.

Day traders should look for two-sided action. We did not get a good PMI from China and that will not provide the tailwind we were hoping for. The FOMC minutes had a positive influence, but late day selling stripped those gains away. This pattern is bearish. I was also hoping for friendly comments ahead of the G20 meeting and the remarks were antagonistic. We are likely to see position squaring ahead of this major event and the market will chop around today. I don't believe we will see a directional move today. The range will be established in the first 90 minutes and we should stay within that range the rest of the day. Resistance is at the 200-day moving average ($275.90) and support is at Thursday's low ($272.40).

I was hoping for more strength into the G20 meeting and we didn't get it. If the reaction is negative we could test the lows from last week. If the reaction is positive we could rally to the 100-day moving average. We are not going to gamble with our gains. Take profits on long positions before the closing bell.

.

.

Daily Bulletin Continues...