No Deal With China – Only A Cease Fire – Take Profits On Longs

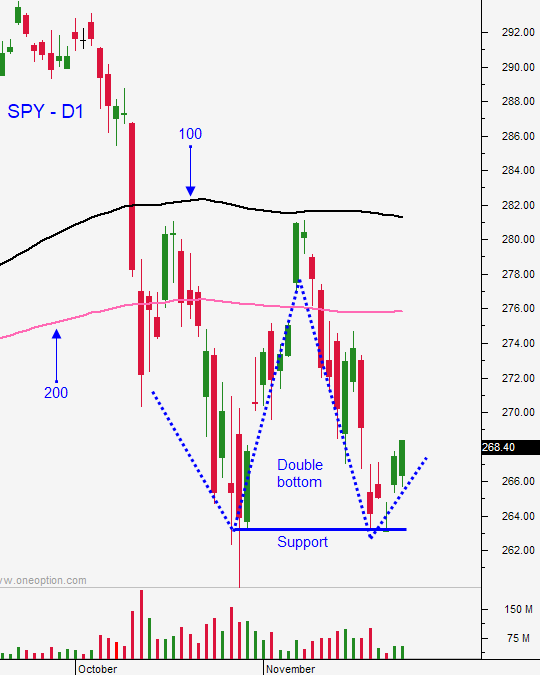

Posted 9:30 AM ET - In the last week the market has gotten exactly the news it needed and this morning it will challenge the 100-day moving average. The G20 meeting between Trump and Xi went well and a 90-day deadline for a trade bill has been set. Last week “Fed speak” and the FOMC minutes were a bit more dovish and we could be entering the final stages of monetary tightening. The macro backdrop is deteriorating and without these two events the market would not have been able to bounce.

We sold our SPY position last Friday at $275.50 for a $12 gain. The trade talks could have gone either way and we took profits in a fickle market. I don't gamble so I have no regrets. Now that the news is out we can gauge the reaction and wait for the next opportunity.

Trump agreed not to increase tariffs from 10% to 25% in January and new tariffs on $260 billion worth of Chinese goods will not be imposed during the 90-day truce. China will resume buying US commodities (agricultural and energy) and they will reduce tariffs on automobiles from the US. This cease-fire will continue as long as negotiations progress.

China posted its weakest PMI and 28 months (50.0) and many manufacturers have already shifted supplies. US retailers and manufacturers stocked up on inventory ahead of a potential tariff hike and this surplus will weigh on China’s Q1 growth. Easing by the PBOC has not spurred activity. These are all warning signs.

Canada, Mexico and United States signed a new trade agreement over the weekend, but it still has to be passed by legislators.

Trump wants $5 billion for the wall and he might shut down the government. Most of the budget has been approved (70%) so this would not be a full blown shut down. With more and more caravans forming there is a sense of urgency and I believe he will stick to his guns.

The Fed is a little more dovish, but they will raise rates in two weeks. Investors are breathing a little easier after last week's comments, but the Fed is still in tightening mode. This relief rally is on borrowed time.

I won't go through all of the dark clouds on the horizon, but there are many. We've seen serious technical damage in the last two months and that is a warning sign during the most bullish time of the year.

Swing traders should remain in cash. The 100-day MA will be challenged today and it should provide resistance. I believe that once the bounce stalls a good shorting opportunity will present itself.

Day traders should let the early rally play out. Watch for a shorting opportunity in the first 30 minutes of trading. If the market can hold the gains it will challenge the 100-day moving average. A breakout above that level would prompt more buying and the rally could extend the next few weeks. I view this scenario as unlikely (25%).

I believe the rally today will present an excellent shorting opportunity. That is how I will be positioning myself. I'm going to make sure that I see a soft bid before I start shorting and it might not be today. The market should back off the next few days and it will make multiple attempts at breaking through the 100-day MA. As we get closer to the FOMC (12/19) resistance will build.

There is no deal with China, only an agreement to continue negotiations. Both sides are still miles apart. If you are long I urge you to take some profits.

.

.

Daily Bulletin Continues...