Market Bounce Will Continue – Ride Profits and Use These Levels

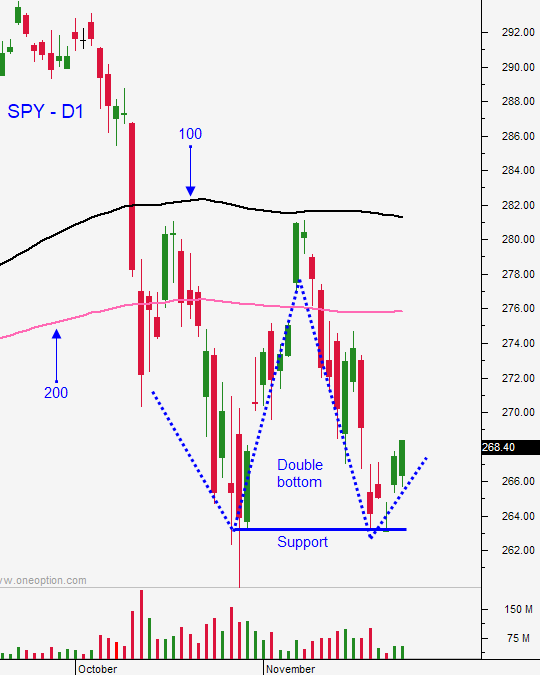

Posted 9:30 AM ET - We are long the S&P 500 and we are going to ride this bounce. Yesterday, shorts ran for cover after Fed Chairman Powell said that the Fed was likely to pause next year. This afternoon we will get the FOMC minutes and other Fed officials might also feel that we are getting closer to a neutral policy. Tomorrow China will post its PMI and the number should be good. The S&P 500 will challenge the 200-day moving average before the close Friday.

Shorts will not be aggressive ahead of the G20 meeting. Both leaders will benefit from friendly comments and the rhetoric should be upbeat for at least a week. This will spark additional buying and seasonal strength will provide a tailwind.

If the comments are particularly constructive and if Trump postpones additional tariffs (current 10% rate does not increase to 25%) the market could reach the 100-day moving average. Trump has already stated that he wants to impose the increase, but he will hold off on new tariffs. This tweet could be a ploy. If Trump does not increase current tariffs as promised it could be seen as an olive branch.

It's important to realize that the current rally is nothing more than a bounce. Serious technical damage has occurred during the most bullish time of the year and that is a warning sign. Sellers have been relentless and they will look to reduce risk once this bounce stalls.

Brexit, Italy's budget, a December rate hike, a possible government shutdown, no trade deals with Europe/China, slowing global growth, tougher earnings comps in Q4, human caravans at the southern border, Democrat investigations of Trump and a host of other dark clouds loom on the horizon.

Enjoy the run while it lasts and make sure you have intraday stops in place. Swing traders are long the SPY from $263.50 and our target is $276. Raise your stop to $271 on an intraday basis. We will keep moving our safety net and our target upward each day. If the market happens to reach the 100-day moving average a great shorting opportunity will present itself.

Day traders should trade from the long side. After a massive run we should expect early weakness. Sellers will test the bid. Support will be established and trading could be pretty dull early in the day. The FOMC minutes should spark additional buying this afternoon. Lower opens and higher closes are bullish. We should also see follow-through on Friday ahead of the G20 meeting.

We patiently waited for this bounce and now it's time to manage profits.

.

.

Daily Bulletin Continues...