Market Has No Catalysts – This Bounce Is Almost Out of Gas

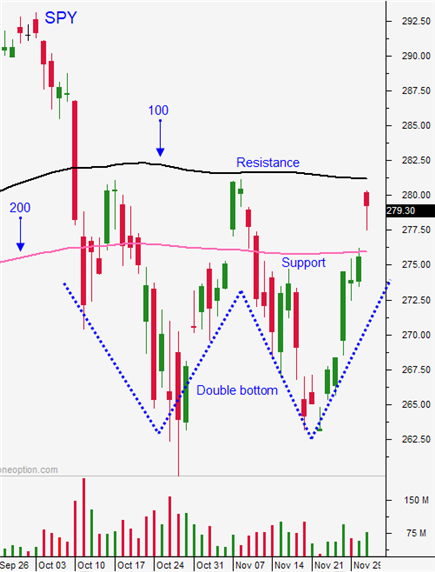

Posted 9:30 AM ET - Yesterday's reaction to the G20 meeting between Trump and Xi was like a cold hand shake. The embrace was there, but it did little to satisfy. There weren't any specifics, just a cease-fire and a 90-day deadline. Stocks rallied on the news, but the S&P 500 was not able to challenge the 100-day MA. If Asset Managers were worried that they would miss a year-end rally, we would've seen a steady grind higher through SPY $281. The appetite for stocks was lackluster and the headwinds are blowing.

Chinese tariffs are not an immediate market threat and the Fed is a little more dovish. These were the two big remaining catalyst this year and the gains this week are likely to mark the high for the rest of the year. I don't see any "drivers" to push us higher, but I do see plenty of dark clouds.

ISM manufacturing, durable goods orders, ADP, the Beige Book and the Unemployment Report will be released this week. Domestic economic activity should be stable and strong.

The budget deadline is approaching and Trump could shut down the government if he does not get an additional $5 billion in funding for the wall. New caravans are forming and there is a sense of urgency. This would be a small shutdown since 70% of the budget has been approved.

Swing traders are on the sidelines. I believe that the market will make its final push higher this week. The FOMC is next week and it is a likely speed bump (the Fed will hike rates). I don't like shorting into year-end, but I might consider it if the SPY gets above the 100-day MA.

Day traders should wait for support this morning. Once it is established, favor the long side. We still have some positive momentum. Support is at SPY $276 (200-day MA) and resistance is at $281.24 (100-day MA). After the initial move yesterday, the action slowed down. The market will be closed tomorrow and trading activity could be light today. Reduce your size.

Once this relief rally runs its course a nice shorting opportunity will present itself. The higher we go the better.

Daily Bulletin Continues...