Market Wants Action From Fed and Trump – Not Words

Posted 9:30 AM ET - After the bloodbath Tuesday, the S&P 500 is down another 45 points before the open today. Robust earnings, strong domestic economic growth and seasonal strength have failed to attract buyers. Sentiment has soured dramatically in the last two months and the dark clouds continue to pile up. This is why we took profits on our long SPY position last Friday. The downside risks outweigh the upside rewards.

China and the US have a 90-day truce, but few believe that a deal is close. A CFO for major Chinese company was arrested in Canada for violating US/Iranian sanctions last night and this could add to tensions. During the negotiations Trump will not increase tariffs and China promises to buy US commodities (agricultural and energy). Trump has labeled himself "tariff man" and he likes the thought of raking in billions in tax revenues. This is probably a negotiating ploy to demonstrate that he will follow through on his plan if a deal can't be reached.

The Brexit deal seems to be slipping away. Theresa May does not have the votes she needs and she wants to postpone it. Unfortunately, she needs another vote to be able to do that. If successful she will have to return to the EU to negotiate concessions.

Global economic conditions are deteriorating. The yield curve is flattening and oil prices are tanking. These are both signs of a likely economic recession.

The Fed will hike rates next week. Their tone has been more dovish, but chairman Powell walked back some of the comments he made last week. Asset Managers feel that the Fed's agenda is too aggressive.

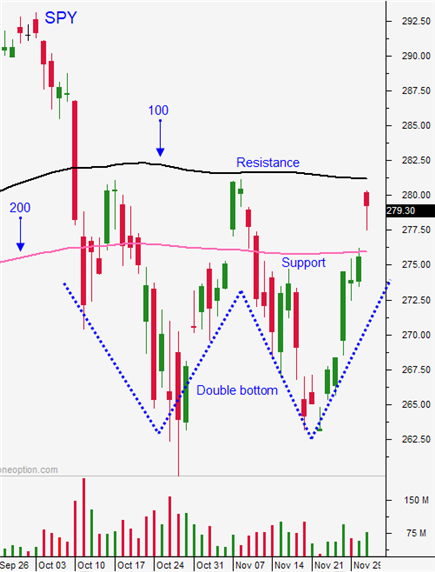

Severe technical damage has been done. The S&P 500 fell through the 200-day moving average like it wasn't even there. This morning's drop is within striking distance of the low from two weeks ago.

ISM manufacturing was strong (59.3) on Tuesday and ADP (179,000) was in line this morning. Domestic economic conditions are strong, but sellers are worried about global conditions.

After Tuesday's massive decline I was hoping to short a bounce back to the 200-day MA, but that's not going to happen. The market drop is overextended and I'm going to wait for support. Given the recent bloodbath I believe the Fed will hike and reduce to 2-3 hikes next year. They usually give the market what it expects and a rate hike next week is priced in. Two or less hikes next year would spark a bounce. It's too early to spell out the various scenarios next week and I will do that Monday and Tuesday.

Swing traders should remain in cash. The overnight swings are massive and unpredictable.

Day traders need to let the market come in. Support is at SPY $264. I will be looking to play the long side and I might have to wait all day for an opportunity to set up. There is simply too much risk to get short after such a huge drop. Snapback rallies can be violent and very costly. Use the first hour range as your guide. If we are above the high, trade from the long side. If we are below the low, trade from the short side. This market is ideal for day traders, but you have to be patient.

Regardless of how the month plays out, 2019 is setting up to be bearish.

.

.

Daily Bulletin Continues...