Market Will Compress In the Middle of the Range and Wait For FOMC

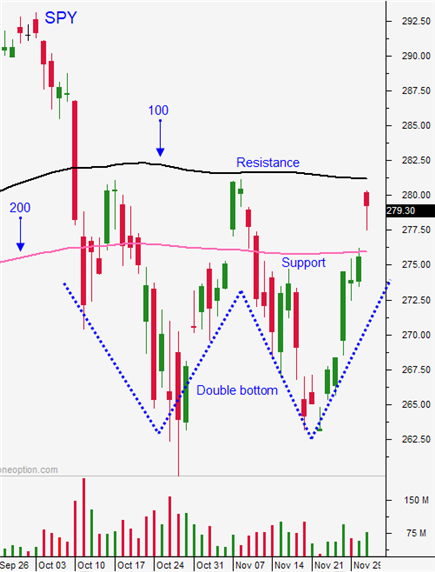

Posted 9:30 AM ET - Yesterday the S&P 500 fell to its low from two weeks ago just after the opening bell. That support level held and stocks rebounded late in the day. We're in the middle of the 2 month trading range and buyers will wait for the FOMC statement next week. A rate hike is expected.

The Fed has some breathing room and dovish remarks are critical. Inflation is not a concern and hourly wages only increased .2% in the jobs report released this morning. In November 161,000 new jobs were created and that number is a little light. ISM services came in at a robust 60.7 yesterday.

The issue is not domestic growth. Global economic conditions are deteriorating and the trend is likely to accelerate. US retailers/manufacturers have a glut of inventory that they need to work off and they ordered ahead of potential tariffs. China's growth is likely to slip in Q1 as a result.

A full-blown trade war with China is still possible. The G20 meeting yielded a cease-fire, but that is far from ideal. ”Tariff man” needs to tone down his rhetoric.

There are plenty of dark clouds on the horizon, but the Fed will determine short term market direction. Investors don't want talk, they want action. They want a trade deal and they want the Fed to curb its tightening agenda.

Swing traders should remain in cash. The market is likely to chop back and forth ahead of the FOMC statement next week. The S&P 500 is in the middle of its trading range for the last 2 months and prices will settle in. If the Fed reduces its rate hike projections on December 19 we could see a rally back to the 200-day moving average. Nervous investors will take a deep breath and a mini year-end rally will unfold. If the Fed is steadfast we will test the low of the year. Without question the upside rewards are smaller than the downside risks.

Day traders should look for choppy action. If you took my advice yesterday and focused on the long side you did well. That early drop was overextended. Now that we're in the middle of the two month range, we should settle in. Expect a range to be established in the first 90 minutes of trading. I will be fading moves on the extremes (short near the highs of the day and buy near the lows of the day).

The Fed will determine if we get a lump of coal in our Christmas stockings next week.

.

.

Daily Bulletin Continues...