The Fed Will Determine If We Close 2018 On the Low of the Year

Posted 9:30 AM ET - My comments will be limited this week due to family health crisis. Thank you for your prayers.

Comments were posted Sunday night.

There is one remaining news event this year and it is a big one. The FOMC statement will be released a week from Wednesday. A few different scenarios could play out and we are likely to chop back and forth until the release.

If the Fed stays steadfast the market will make a new low for the year.

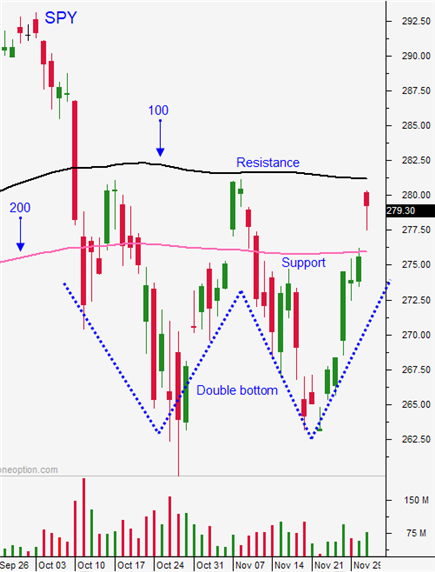

If the Fed postpones the December rate hike, an initial bullish reaction will spark buying and the SPY could challenge the 200-day moving average. This bounce will be temporary and investors will wonder when the next rate hike will come. The Fed typically gives the market what it expects and a rate hike is baked in.

If the Fed raises rates on December 19, but it reduces its projections for 2019 we will see a nice rally. If they favor 3 rate hikes we might get back to the 200-day MA. If they favor 2 rate hikes we could get back to the 100-day MA.

Fed speak the last few weeks has been more dovish and I believe the last scenario is likely.

There are plenty of dark clouds on the horizon and the selling pressure has been very heavy. No Brexit deal, Italy’s deficit spending, no trade deal with China, a flattening yield curve, low oil prices, global economic weakness and tougher earnings comps in Q1 are just some of the issues. The market barely bounced on the G20 news last week and it fell 200 S&P 500 points in 4 days. The momentum clearly favors the bears and this is a bad omen for 2019.

I would favor the short side until the FOMC. If stocks hit a deep air pocket I will look to buy on weakness ahead of the Fed. I will not think about the long side until just before the release.

.

.

Daily Bulletin Continues...