Buy Dips Ahead of the FOMC Next Wednesday

Posted 9:30 AM ET - I continue to say goodbye to my companion, my mentor.... my mom. Her incredible life will end soon and we are grateful for your thoughts and prayers.

The market continues to trade off of tweets and minor news events. All that really matters the rest of the year is the FOMC statement next week.

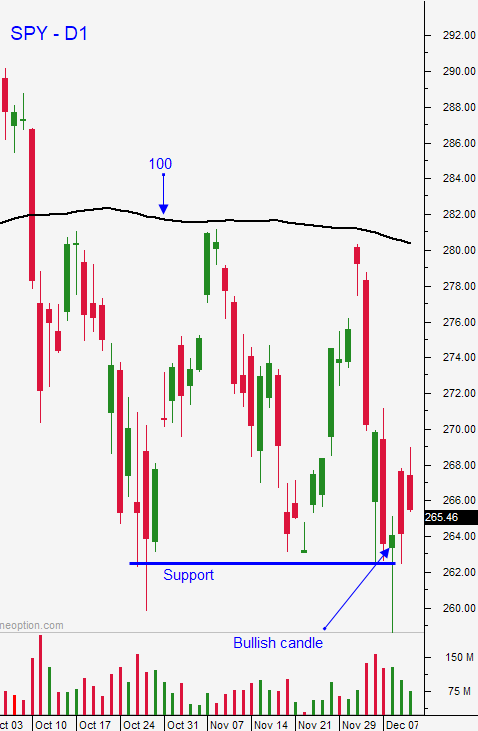

The Fed needs to follow through on the expected quarter point hike and they need to half the number of hikes next year. This is the best scenario and it would spark a rally into year-end. I believe that the 200-day MA is attainable, but the 100-day moving average is out of reach. In January and February trade talk negotiations need to show steady progress and the mudslinging between China and the US has to stop.

I believe that the Fed will deliver and we will see a small year-end rally. The selling will resume in the first two months of 2019.

Swing traders should buy the SPY at $264. We are only going to take a half position at this time and we are not going to use a stop. I want to buy dips into the FOMC statement on December 19.

Day traders should trade the "edges". The market is going to stay in a trading range and once the directional movement has stalled, a reversal is likely. Short the top and buy the bottom. If I were day trading I would favor the long side at this level. Set targets and take profits. This is an excellent day trading environment.

.

.

Daily Bulletin Continues...