Buy More SPY At This Price and Hold Into the FOMC Wed

Posted 9:30 AM ET - There is only one thing that matters the rest of the year. The FOMC statement tomorrow will determine market direction for the next two months. A rate hike and a neutral stance would attract buyers. This is the only outcome that can stop the bleeding.

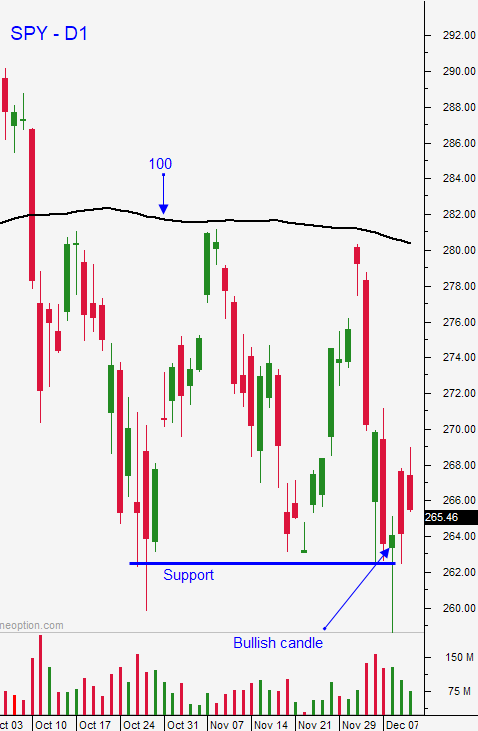

The S&P 500 fell below horizontal support yesterday and the selling pressure has been relentless. This is very unusual heading into year-end and it is a bearish omen for 2019.

Global economic activity is slipping and tariff wars could accelerate the decline. Retailers and manufacturers in the US have stockpiles of inventory that they ordered ahead of the tariffs. China's economic numbers will drop significantly in the next few months and many supply lines have been moved to other countries.

Hawkish monetary policy does not make sense when the rest of the world is contracting. Inflation is moderate and the Fed has plenty of breathing room. I believe that they will heed the warning signs and that they will pause after they hike tomorrow. This would be the most bullish scenario for the market. We are ready to swallow the bitter pill now so let’s get it done so that we can move forward. If the Fed does not raise rates tomorrow we will get a knee-jerk rally. It won't last very long and investors will wonder when the next rate hike will come.

Swing traders bought the SPY yesterday when it fell below $256. We only took a half position and we will hold without a stop. Place an order to buy the other half at SPY $252 today.

Day traders should be cautious today. Expect two-sided trading and wild moves ahead of the Fed. Traders will "square up" and the action should die down later in the day. I believe a wide range will be established in the first two hours and we will trade at both extremes during the day. When the momentum stalls in one direction, get ready for a reversal. I believe the low from Monday will hold.

If the Fed raises rates and it projects more than two hikes in 2019, the market will close on its low of the year.

.

.

Daily Bulletin Continues...