The Most Bullish FOMC Scenario – If It Happens SPY $276 In Range

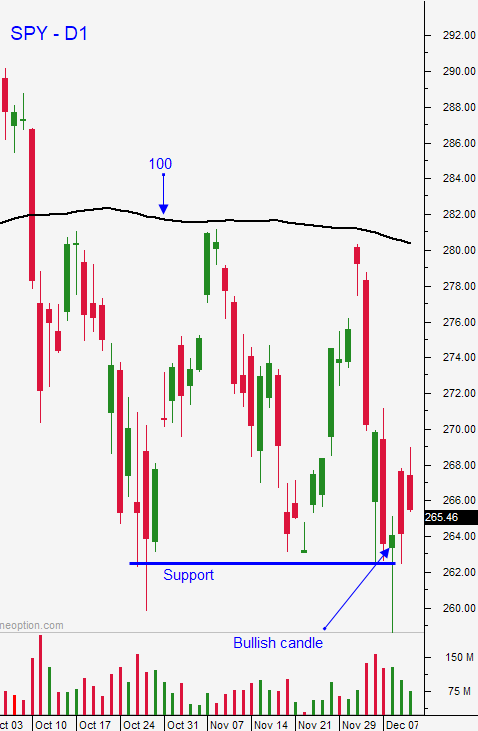

Posted 9:30 AM ET - Last week the market struggled to tread water. Horizontal support at SPY $264 was breached on Friday and we closed on the low of the day. Serious technical damage has been done and investors want action, not words. The Fed needs to take its foot off the brake this week or we will close on the low of the year.

Trade negotiations with China have a 90-day deadline. The rhetoric has been fairly calm, but Trump could fan those flames at any time. China has softened its tone regarding its 2025 agenda to become the global leader. It still plans to do this; it just won't be as vocal about it. China is already feeling the pinch. Factory orders are subsiding and supply chains have been moved out of the country. Companies loaded up on inventory ahead of potential tariffs and this glut needs to be worked off. I'm expecting dismal numbers from China in Q1.

Fed comments have been a little more dovish recently. They say they don't watch the market, but they do. Investors are worried about a global recession and they are selling stocks. Earnings comparatives will be tough to beat because the tax cuts went into effect a year ago. Corporate buybacks have also slowed and this safety net is gone. Asset Managers are buying bonds (yields are declining) and the yield curve is flattening. This is a sign that a recession might be looming.

Here is the most bullish scenario this week. The Fed needs to hike this week - the market is expecting this. A pause might seem much more bullish, but it's not. Investors will instantly worry that the rate hike will happen during the next meeting and the market will be on pins and needles. Any rally will not last more than a couple of days. A rate hike with dovish comments and the decrease in the number of projected rate hikes next year would excite buyers. I believe the market can shoulder two rate hikes in 2019. Anything more is bearish for the market.

A rate hike and a material drop in rate hike projections for 2019 is a likely scenario. I will be looking to buy once I see support this week. I like the $256 level. Swing traders should place an order to buy a half position at SPY $256. We will hold without a stop and we will probably add to the position before the FOMC statement.

If the Fed hikes and they do not soften their tone, the bottom will fall out. I feel that this is very unlikely. The warning signs are present and dovish Fed speak has not attracted buyers. Promises of a trade deal from the White House are also not resonating with buyers. Bearish sentiment is high and the selling pressure has been persistent. It is time for the Fed to calm nerves into year-end.

Day traders should favor the short side. Major horizontal support has been breached and the momentum favors the downside. Expect choppy trading into the FOMC. The volume and activity will decline into the statement and traders should be "square up" by the end of the day. Tuesday and Wednesday could be dull.

After the FOMC statement we should see active trading. I believe the Fed will stabilize the market this week. They do not have to worry about inflation so they have breathing room. If they pause, the bounce will be very brief and there will be a shorting opportunity. If they follow the scenario I've outlined above we could have a nice little year-end bounce.

.

.

Daily Bulletin Continues...