Buy More SPY Ahead of the Fed At This Price – Keys To A Big Bounce

Posted 9:30 AM ET - And now for the moment we've been waiting for… the FOMC Statement. This afternoon the Fed will raise rates a quarter point. Their comments will be scrutinized and there are several components that will determine market direction for the next few months.

I believe the base scenario is a rate hike and language that suggests the next increase won't come until May. This should lift the S&P 500 at least 50 points in the next few days.

The market will rally more than that if the Fed moves to a neutral stance and they remove the phrase "further gradual increases". Another "shot in the arm" will happen if the Fed decelerates the pace for balance sheet reduction. These two bonus components could get us back to the 200-day moving average. Ideally, the Fed will acknowledge global economic contraction while maintaining its US growth projections. A moderate inflation outlook would also be helpful.

Earnings projections have been slashed and the overnight releases (FDX and MU) are not good. FedEx lowered its estimates due to weakness in Europe. Micron lowered its DRAM projections for 2019 from 20% growth down to 16% growth.

Chinese trade talks are taking place and a phone call was made to discuss trade matters overnight. Treasury Secretary Mnuchin confirmed that face-to-face trade talks with China will resume in January. China has been buying US soybeans so the tone is improving.

Italy made some adjustments to its budget and it said it has a deal with the EU.

Trump is backpedaling on a government shutdown. He will find other ways to fund the wall and he might use part of the defense budget.

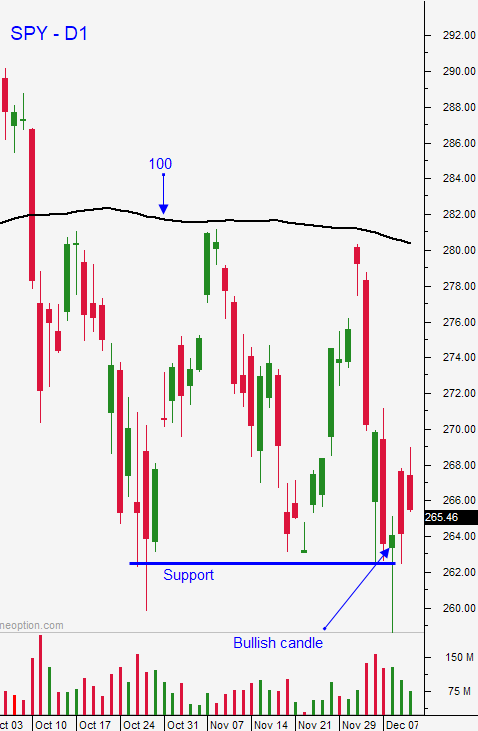

Swing traders bought the SPY at $256. Try to buy more ahead of the Fed at $254, but cancel that order at 1:55 PM ET if you have not been filled. After the FOMC statement use a closing stop (last 5 minutes of trading) of $253. The market is grossly oversold and dovish Fed remarks will spark a short covering. Bearish sentiment is high and that will fuel the bounce.

If the Fed does not hike today and it does not reduce the number of hikes in 2019 the bounce will be very brief. Investors will constantly be looking over their shoulder. We want the rate hike, we want a reduction in the number of hikes next year (a move towards neutrality), we want them to imply that the next possible hike won't come until May and we want the Fed to stop reducing its balance sheet. Any mix of these components will determine how high the market can bounce in the next two weeks.

Day traders need to be careful on the open. Make sure that the gains hold before trading from the long side. We will get an initial move in the first two hours and then the action will die. Give the FOMC reaction a little time to unfold, then follow the momentum. Resistance is at SPY $260.20, $268.70 and $270.30. Support is at SPY $253, $240 and $234.

Look for a much softer tone from the Fed today. We should see a 50 point rally off of the basic news that I am expecting and each additional component will get us closer to the 200-day MA.

.

.

Daily Bulletin Continues...