Fed Puts Coal In Our Stockings – We Are Back In Cash – No Catalyst

Posted 9:30 AM ET - Yesterday the Fed put coal in our stockings. The FOMC statement was the last potential catalyst of the year and we did not get what we wanted. Stocks sold off on the news and the market closed on its low of the year. The early bounce this morning is not likely to hold.

As expected, the Fed hiked interest rates a quarter of a point and they reduced their projections for next year (two rate hikes). They did not remove the phrase "need for gradual increases" and they still plan to reduce their balance sheet by $600 billion. Furthermore, they lowered their GDP forecast for 2019. The Fed had plenty of breathing room and they said that inflation is below their target.

Earnings reactions this week (Oracle, FedEx and Micron) have been negative and guidance for next year was cut.

A government shutdown looms, but it will not be far-reaching since 70% of the funding has been secured. Trump has backed off and he will try to allocate some of the defense budget to the wall.

Brexit is in limbo. The EU and England were close to a deal but Theresa May could not get it through Parliament.

Italy says it has a budget deal with the EU.

I believe that China's economic numbers will be extremely light in December. Exports were heavier than normal the last six months and buyers stocked up ahead of potential tariffs. This inventory needs to be worked off.

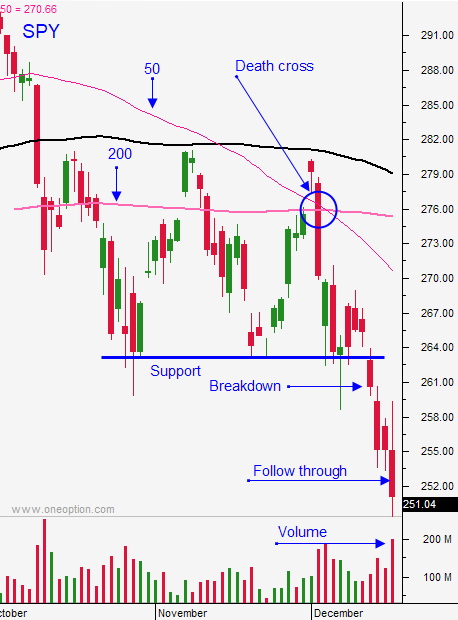

Swing traders were stopped out of the SPY for a $4.50 loss yesterday when the index closed below $253. We are going to watch from the sidelines for a day or two. The Fed did not give us what we wanted, but the tone was decidedly more dovish. Stocks have been badly beaten down and we are due for a short covering bounce.

Day traders should look for an opportunity to fade this bounce. The chart of the S&P 500 is very bearish and all of the major technical support levels have been breached. Favor the short side.

I don't see any catalysts the remainder of the year and the momentum points lower.

.

.

Daily Bulletin Continues...