A Bounce Is Coming – Stay In Cash Until It Stalls – Then Go Short

Posted 9:30 AM ET - There is not any new information overnight. Investors were hoping for a dovish FOMC statement and they did not get it. This was the last possible catalyst for the year and there is nothing to stop the bleeding. Stocks continue to make new yearly lows.

Wednesday, the FOMC raised rates a quarter of a point and they reduced 2019 projections (two rate hikes instead of three). This was the base case and there were incremental dovish steps that could have been taken. The Fed could have set the next rate hike for June and they did not. They continue to believe that "gradual rate hikes are needed". The Fed will continue to reduce its balance sheet ($600 billion). That pace could have been reduced, but it wasn't. They did mention a slowdown in global economic activity and they lowered their domestic GDP growth in 2019. The Fed also mentioned that inflation is below their target so they had plenty of breathing room to take their foot off the brake. Investors did not like the statement and the Fed gave us the bare minimum.

Trump is threatening a government shutdown today. More than 70% of the government is funded and this news should not rattle investors.

A Brexit deal was very close, but Theresa May could not get it approved by her own Parliament. The whole deal is unraveling.

Trade talks with China will ramp up in January and there have been phone conversations in the last week between government officials. Investors don’t care about talk, they want action.

Earnings from Oracle, FedEx and Micron produced a negative reaction and guidance was weak.

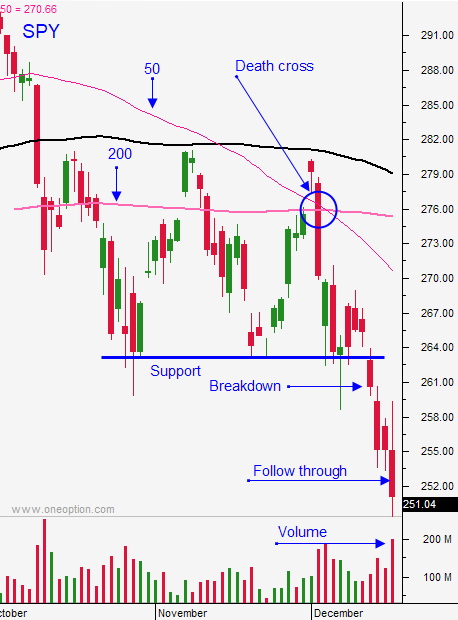

A drop like we've seen in the last two months is a warning sign for 2019. This is the most bullish time of the year and we are making new lows.

Bearish sentiment is as high as it's been in 10 years. At a forward P/E of 15, bad news is priced in. I believe that a short covering rally could produce a bounce into year-end. Unfortunately, it will only be a bounce and it will set up a shorting opportunity.

Swing traders should remain on the sidelines. We will wait for that bounce and we will get short when it stalls. Yesterday I noticed pretty good buying near the low of the day and that support should hold.

Day traders should wait for an early low and a bounce. I will be trading from the long side today. Once support is established we should be able to grind higher into the Christmas holiday. Monday is a half day and Tuesday the market is closed. Trading volume will decline and the range will compress. Trim your size and activity.

I will not be posting comments Monday or Tuesday.

Wishing you and your family a Merry Christmas!

.

.

Daily Bulletin Continues...