Take Profits On the Puts – Market Bid Is Still Decent

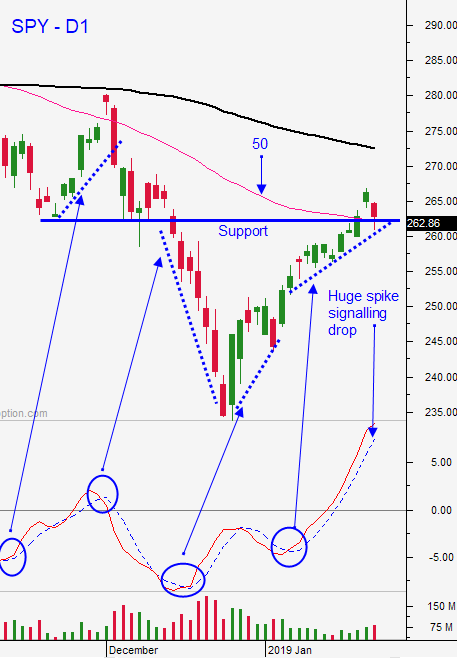

Posted 9:30 AM ET - Yesterday the market tested the 50-day moving average for a second time this week and it bounced off of that support level. The bid is still relatively strong and earnings season has been better than feared. Semi-conductor stocks are up this morning and the earnings from the group were good. Intel will report after the close today. The market wants to consolidate at this level so we are going to take profits on our puts.

Yesterday I suggested that swing traders buy puts on the open. The SPY was above $264 and it is poised to open below that level. You should be able to make a little money or the trade. I don't want to be short into mega-cap tech stock earnings next week (Amazon, Microsoft, Facebook, Alibaba and Apple) now that we are above the 50-day MA.

Texas Instruments said revenues were down 1% year-over-year. They beat EPS by a few cents and guided towards the low-end of the range. The stock is up after posting soft results and that could be a sign that tech stocks have a little upside. XLNX and LRCX posted solid numbers.

The government shutdown continues and the State of the Union Address that was scheduled next Tuesday has been canceled. The longer this drags on the greater the impact on economic growth.

Next week the FOMC will release its statement. We should see a more dovish tone judging from the comments Fed officials have been making recently.

England will hold a major vote next Tuesday and it could pave the way for a fresh national election. Brexit is back to square one.

Trade talks with China are scheduled in a week. Rumors (pro and con) are circulating – don't believe them. This process will take time and the March deadline will be extended if the talks are constructive.

Flash PMI's out of Europe and Japan were particularly weak. Eurozone fell to 50.5 (51.4 expected) and Japan felt to 50 (52.6 expected).

Swing traders should go to cash. We took a shot and the expected outcome (a close below the 50-day moving average) did not materialize. We will let this wave of news pass and we will monitor the price action. I'm expecting consolidation in this range and a breakdown below the 50-day moving average in the next few weeks. Even if the shutdown ends, the economic damage is done. A trade deal with China won't stop the global economic slowdown that was already in progress before the tariff war. Big declines like we saw in December have aftershocks and I still believe the next big move is down.

Day traders should let the dust settle. The S&P 500 is been trading in positive and negative territory before the open. Support is at $262 and resistance is at $264. Use these levels as your guide and fade the extremes. We are likely to stay in a range. Try to make your money early. Trading volume has been light in the afternoon and the action is choppy. If by chance we break out of the $262-$264 range, favor that side.

A very busy news cycle lies ahead and we should see good movement.

.

.

Daily Bulletin Continues...