Day Traders – Get Short When the Momentum Stalls Today

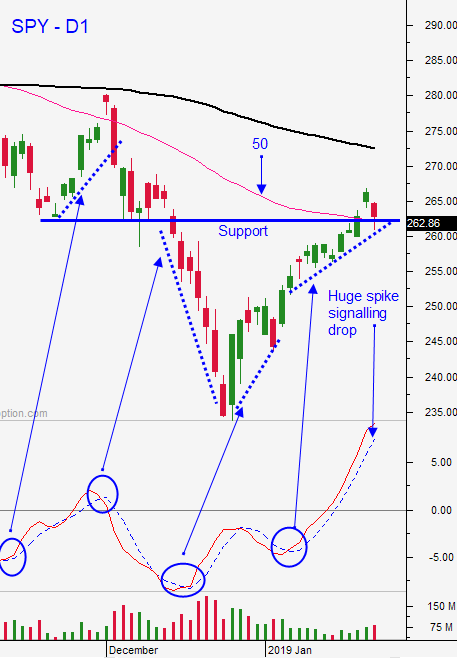

Posted 9:30 AM ET - This week the market tested the 50-day moving average twice and it bounced off of that support level. Earnings season is in full bloom and the results have generally been good. The news has been relatively light and rumors have been driving the action intraday. The S&P 500 is up 25 points before the open and these moves have typically been faded.

Rumors are circulating that DC might temporarily open the government for three weeks while they work on a compromise. Trump is pushing for the wall and if he can't secure funding he will try to use funds that have been appropriated elsewhere. It is possible that he gets what he can from Dems and then uses alternative sources to build the wall.

Trade talks with China will resume in a week. Both countries want to resolve this and China's economic activity is suffering. Actions from the PBOC are not bearing fruit. This process will take many months and the deadline will be extended.

Flash PMI's from Europe and Japan were soft yesterday and both are almost in contraction territory. Official PMIs will be posted next week and we will get a read on China’s growth.

Intel was the major earnings announcement overnight. They guided revenues lower and the stock is down 6%. That is contrary to what we saw from LRCX, XLNX and TXN yesterday. Amazon, Apple, Facebook, Microsoft and Alibaba will post earnings next week and that should keep buyers engaged.

Next week the FOMC will release its statement and they have been a little more dovish.

There will also be a critical Brexit vote in England next week.

Swing traders should remain in cash. We made a little money on our puts yesterday, but we were early on that trade. We need to let this bounce exhaust itself. The S&P 500 could challenge the 100-day moving average, but the headwinds are blowing. There are still many unresolved issues and global economic activity is waning. I believe the next big move is down.

Day traders should let the early rally run its course. Look for opportunities to short. Sellers will wait for the momentum stall and they will reduce risk. The market will not move higher until the downside is tested. This same pattern was present yesterday. Once support is established (SPY $264) you can trade from the long side. The intraday price action has been choppy.

The calendar is filled with major news events next week. I believe the market will settle into a range today ahead of a busy week.

.

.

Daily Bulletin Continues...