Buy Puts Today and Use This Stop!

Posted 9:30 AM ET - Try the indicator in the chart below at WWW.ONEOPTION.COM. It is the only indicator I use for day trading the S&P 500 emini futures contract.

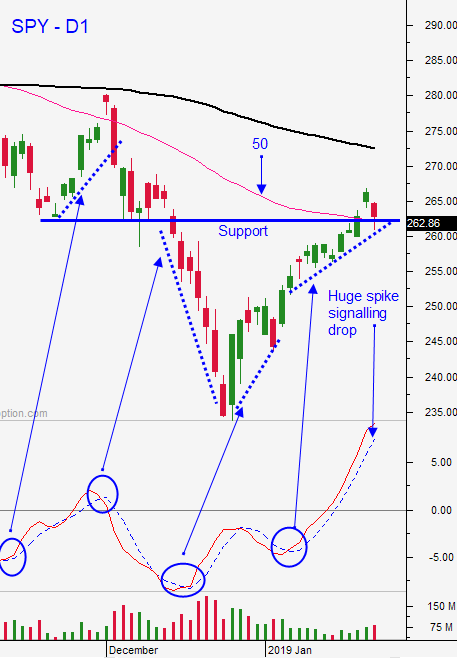

Yesterday the market showed the first signs of weakness. The selling pressure was steady and the SPY breached the 50-day MA during the day. It did close above it, but another drop below it could pave the way for more selling.

Trade talk rumors are circulating – don't believe them. Last week we heard that Trump was going to remove all tariffs and yesterday we heard that a trade planning meeting was canceled. Both were false reports. This process will take many months to resolve and the deadline will be extended.

China and the US seem eager to strike an agreement. Both sides are miles apart and the rhetoric needs to remain cordial. China's economic growth is slowing and I believe future data points will be weak. The PBOC has been easing and fiscal stimulus is planned.

Earnings season will unfold gradually. IBM posted a good number yesterday and Capital One missed. UTX is up this morning and ABT is down. The results are mixed so far. The recent market bounce has put us at a juncture where companies need to knock the cover off the ball to advance. If they meet expectations they could easily retrace. Companies that warn or disappoint will be punished. The downside risk is greater than the upside reward for earnings plays.

The government shutdown continues and politicians are not willing to strike a deal.

Brexit is at a standstill. Plan B will be introduced in the next week or two and England needs to secure additional concessions by the EU. That will be difficult since Europe holds the cards. Opposition leaders want to have the entire country vote again on Brexit.

Fed speak has been dovish recently.

Swing traders should short the SPY on the open today. I believe that the 50-day MA will be tested again and it will fail. The selling pressure yesterday was heavy. The pattern of lower opens and higher closes was broken. Typically, gaps down have been bought in the last two weeks and buyers were not interested at this level. We will stop out of the trade if the SPY is > $264 after two hours of trading. Once the 50-day MA is tested we do not want to see a bounce off of it.

Day traders should look for an opportunity to short the opening gap higher. I don't believe the market can rally until it tests support at the 50-day MA. Take profits at that level and wait to see if support fails. It might take a couple of tries, but once it goes we could see additional selling. Use SPY $262 as your guide the remainder of the day. If we are above it, focus on the long side and if we are below it, focus on the short side.

The news is fairly light the rest of the week. If downward momentum is established today it will continue for the rest of the month.

.

.

Daily Bulletin Continues...