Huge News Week Will Reveal Market Strength/Weakness

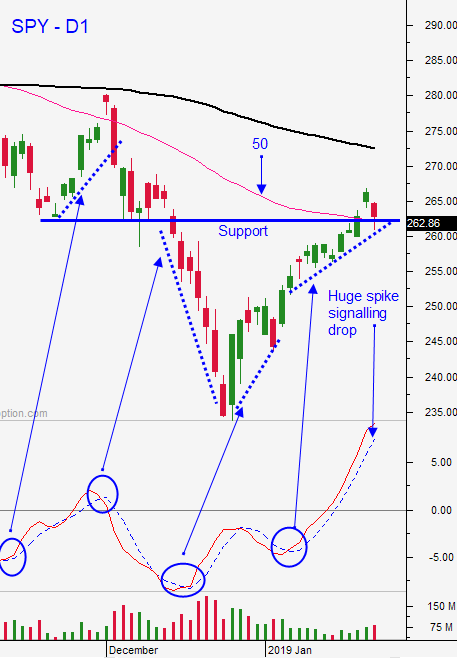

Posted 9:30 AM ET - Last Friday the market staged an impressive rally, but it was not able to get through resistance at SPY $267. Rumors of a government deal and dovish comments from the Fed attracted buyers. This is an extremely heavy news week and traders will have a mountain of information to sift through.

Amazon, Apple, Microsoft, Facebook and Alibaba will post results. Sellers will be passive until these announcements are made. Over 20% of the S&P 500 Has reported and 71% of companies have exceeded estimates. That is typical.

China will release its official PMI this week - they had another negative economic headline. Industrial profits fell 3.1% year-over-year in December. Trade talks will resume in Washington at the end of the week. As long as there is progress the March deadline will be extended. Any negative comments will spark selling.

There is an FOMC meeting and the statement will be released Wednesday. Rumors are circulating that they might curb their balance sheet reduction. The Fed has been too aggressive and they have not accounted for global economic weakness. The tone recently has been more dovish.

The government shutdown will be on hold for three weeks. Congress has to fund the wall or Trump will veto the bill. This news attracted buyers on Friday, but nothing has changed. Congress thinks they can find middle ground.

ISM manufacturing, ISM services, ADP and the Unemployment Report will be released this week.

Theresa May is going to push for legally binding changes from the EU regarding the Irish backstop. If she is successful she could gain the support she needs in Parliament for a Brexit deal.

Swing traders are in cash. The market still has a little gas in the tank, but it needs to hit many of the catalysts this week if it's going to challenge the 100-day moving average. I believe that the news will be mixed and that the market will start to compress. Once the upward momentum stalls we will have a shorting opportunity.

Day traders should expect some early movement and a tight trading range the rest of the day. Almost all of the gains Friday came in the first 30 minutes of trading. Traders are squaring up and they will not take large positions ahead of all of the major news events this week. I will be looking for an early buying opportunity. Wait for the market to find support. The $264 level might provide that. The rest of the day will be relatively dull. Use the first hour range as your guide. Fade the extremes since we are likely to stay in the range.

If the market is going to make a final push higher it needs to happen this week.

.

.

Daily Bulletin Continues...