This Is A Critical Week For the Market – Major News

Posted 9:30 AM ET - The news during the next 36 hours will be critical for the market. We will wait for the reaction and act accordingly.

England will hold a Brexit vote today and Apple will post earnings after the close. Tomorrow before the open the ADP report will be released and BABA and BA will post earnings. The FOMC statement will be released Wednesday afternoon and MSFT, FB, QCOM, TSLA and PYPL will announce after the close. Thursday morning we will get a feel for China's growth and the official PMI will be posted. After the close Thursday, Amazon will post earnings. Friday morning the Unemployment Report and China's Caixin manufacturing PMI will be posted. ISM manufacturing will be released 30 minutes after the open and we could get information on the US/China trade talks during the day.

This is an extremely busy news week. The reactions will determine market direction for the next few weeks.

I believe mega cap tech earnings will be "better than feared" but guidance will not excite investors. These stocks have a little more upside, but the headwinds are blowing.

The most likely scenario for the FOMC is a balanced statement with maximum flexibility. They will acknowledge global economic deceleration and stable domestic growth. Fed speak has been more dovish in the last two weeks and the press conference should be market friendly without any major changes. I don't believe they will signal a slowdown in balance sheet reduction (although they might curb the pace without broadcasting that fact). In general, the reaction should be slightly positive.

US/China trade talks will progress at a slow pace. Both sides want to find middle ground, but they are still miles apart. The initial reaction will be market neutral, but the March deadline will start to weigh on investors when an agreement still seems distant.

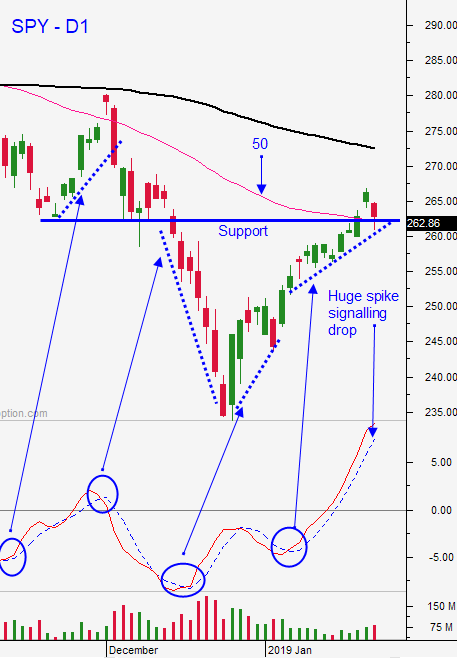

The market will try to challenge resistance in the next week and we will see how much gas is left in the tank. I still believe that the next big move is down. Global economic weakness will overpower trade deals, a more dovish Fed and solid earnings.

Swing traders should remain in cash. We will wait for the events to play out and we will act accordingly. I am not going to chase this rally, but I am interested in catching the next move down.

Day traders should expect tight trading ranges ahead of major news events. The last two days we have seen early moves that lasted a half an hour followed by chop within a range. Expect the same today. Fade the extremes and reduce your size/trade count.

Be patient and wait for the news events to play out this week.

.

.

Daily Bulletin Continues...