Buy Puts – There Are Cracks In the Dam

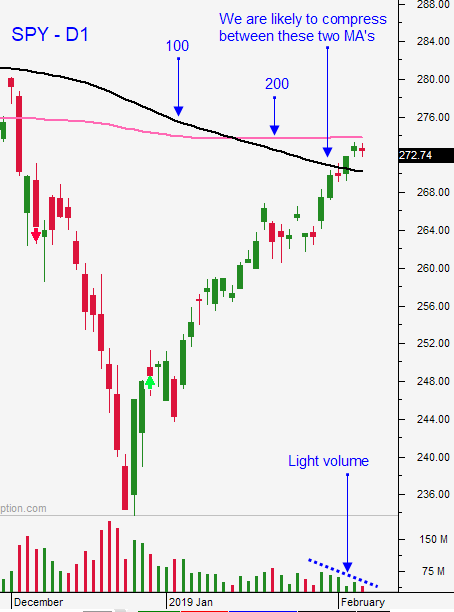

Posted 9:30 AM ET - Yesterday the market tried to advance after breaking through the 200-day moving average the day before. The high of the day was established early and the momentum stalled. In the last 30 minutes of trading we saw a sharp decline. Late day selling is a bearish sign and the price action before the open is tenuous. We are seeing signs of exhaustion.

China's trade numbers were better than feared. Exports rose 9.1% (3.2% drop expected) and imports fell 1.5% (10% decline expected). Trade negotiations seem to be going well and they will end Friday. The market will want the next meeting scheduled immediately (a sign that progress is being made). China's economic growth is slipping and Lunar New Year retail sales have not been this low in eight years.

Germany barely stayed above recession territory. Fourth-quarter GDP expanded .2% following a .2% decline the previous quarter. December retail sales in Germany were down 4.4%. Italy is officially in a recession. Keep in mind that no progress is being made on a US trade deal. This will come back to haunt them once negotiations with China have concluded.

Brexit is in limbo and a hard exit is possible. The EU and the British Parliament are not budging as the 45 day deadline approaches.

Domestic retail sales dropped 1.4% (.1% increase expected). This will weigh on Q4 GDP (this might reduce it to 2%). The market is pricing in strong US economic growth and any surprise favors the downside.

Earnings season has been excellent and now that mega cap tech stocks have reported, sellers will be more aggressive. Valuations are at the upper end of their forward P/E range (16).

The Fed wants to tighten two more times this year and the market is not pricing in any rate hikes.

A government shutdown is possible, but it won't last long. Trump wants voters to know that he supports border security while Democrats support open borders. A temporary shutdown will gain media attention and his message will be delivered. This will be his platform for 2020. He has other ways to fund the wall. The most interesting prospect would be to use the $14B that was confiscated from drug lord Guzman (El Chapo). Knowing Trump he will say that Mexico paid for the wall.

Swing traders should short the SPY on the open today. I am comfortable at this level and I feel the upside is very limited. Domestic economic growth will soften as global activity contracts. Trade deals will keep us from falling off a cliff, but they won't stop the trend. We will use SPY $276 as our stop on a closing basis.

Day traders should focus on the short side. Late day selling and follow through the next morning is what we've been waiting for. I see signs of exhaustion and the 100-day moving average will be tested in the next week. Use SPY $274 as your guide. If we are above it, favor the long side and if we are below it favor the short side.

We've been very patient during the final leg of this bounce and it has been difficult to stay sidelined. The market is ready to roll over and we are going to make money when it does. Expect to take a little heat along the way while the bid softens. When it crumbles stocks will drop quickly.

.

.

Daily Bulletin Continues...