Stay In Cash Until This Happens – Then Buy Puts

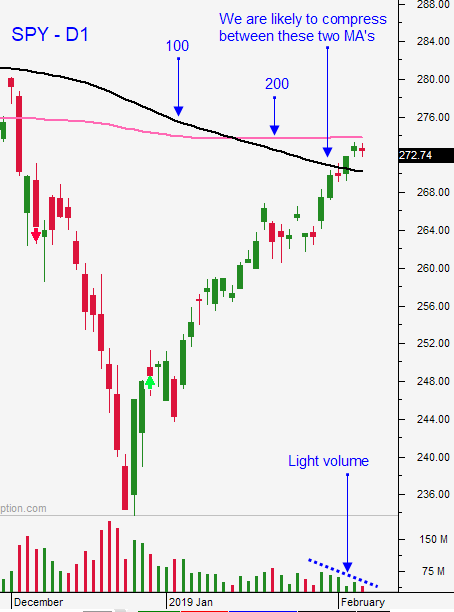

Posted 9:30 AM ET - Yesterday the market rallied above critical resistance at SPY $274. That is the 200-day moving average and the gains held. Most of the action has come overnight and once the initial move is made, the volume drops off. Intraday ranges are very tight and the market is constantly waiting for the next piece of good news.

Trade talks with China seem to be going well. Trump said that as long as there is progress he is willing to extend the March 2nd deadline. As soon as this meeting concludes we need to hear that another one has been scheduled. That would be a sign of progress.

China's economic growth continues to slide and their Commerce Ministry projects that consumption will continue to drop. Retail sales growth during the recently concluded Lunar New Year slipped to its lowest level since 2011. Tomorrow morning China will release its import/export trade numbers. Regardless of the trade talks, their economic growth is deteriorating. A deal will keep it from falling off a cliff, but it won't stop the trend.

Europe's economic growth is miserable. Industrial production in the EU fell 2.7% in December (Y/Y). Italy (fourth-largest economy) is officially in a recession. Brexit negotiations are not going well and a hard exit is possible. By the way, we still do not have a trade deal with the EU.

A government shutdown in the US might be avoided, but that is priced in. Trump is not happy with the deal ($1.4 billion for the wall) and he could veto it just to go on record. Ultimately he will sign the bill and find other means to fund border security.

The Fed has been more dovish, but that tone will change as the market grinds higher. They claim that their decisions are not driven by the market, but they are. Two rate hikes are projected by officials in 2019 and the market is not expecting any.

"The market climbs a wall of worry." This is a well-known adage, but I believe it is not currently the case. Domestic economic growth is strong, but investors are ignoring the global picture. Europe is painted into a corner and the ECB has not raised rates. They have no monetary tools to stimulate activity and debt levels continue to climb. The PBOC has eased 5 times in the last year to no avail.

Swing traders are sidelined. We shorted the SPY at $270 and we were forced to cover at $274 yesterday. I still believe the next big move is down and I'm constantly watching for signs of exhaustion. Late day selling and follow through the next day would get my attention. So would a gap higher and a reversal. We have two major technical levels (100-day and 200-day moving average) that we can use for our entry points. Earnings season has climaxed and sellers will be more aggressive. If the market trades below SPY $273 at any time, take a short position and use a close above $274 as your stop.

Day traders should go with the flow. Momentum is pushing the market higher and you can lean on SPY $274. As long as we are above it, favor the long side. Also use the first hour range as your guide. If we stay inside of it, fade the extremes. The market has been gapping higher and the trading ranges are very compressed intraday. Keep your size and trade count small.

I will day trade from the long side, but I am watching for exhaustion because I want to buy longer-term puts for a swing trade.

.

.

Daily Bulletin Continues...