Stay Bearish – Bad News Is Mounting and the Bid Will Soften

Posted 9:30 AM ET - Yesterday the market tested the 200-day moving average after a soft retail sales report. Stocks found support and the market was able to close above that critical level. Trump will reluctantly sign a bill today that avoids another government shutdown. The S&P 500 is up 12 points before the open as a result. The negative news is mounting and the market is discounting the macro backdrop.

Investors were not overly concerned with a government shutdown and I believe the early "pop" this morning is fluff. Trump will hold a press conference 30 minutes after the open and he will declare a national state of emergency. He wants to secure the southern border and this is how he will fund the wall. We can expect court battles immediately and nasty rhetoric.

Political discord is also impacting England. They can't strike a deal with the EU and their Parliament is divided. The deadline is 45 days away and a hard exit is possible. This would be bearish for the market.

Trade talks with China seem to be going well and the negotiations will continue next week. Based on comments from officials, both sides are still far apart. Trump has not decided if he is going to postpone tariffs that would go into effect in two weeks.

China's economic activity is slipping and there are many data points that confirm this. The PBOC has been easing aggressively to no avail.

Europe wishes it had this tool to stimulate the economy, but they are painted into a corner (0% interest rates). Germany's economy narrowly escaped recession territory in Q4 (.2% growth). Growth is slipping quickly in the EU and they have not negotiated a trade deal with the US. The latest round of bad news showed that European car registrations were down 4.6% in January.

Domestic retail sales declined a surprising 1.3%. The world is counting on strong US growth and soft numbers will weigh on the market.

Earnings season is almost over and the results were excellent. Stocks are trading at the upper end of their valuation range (forward P/E of 16) and everything has to go well for them to tread water.

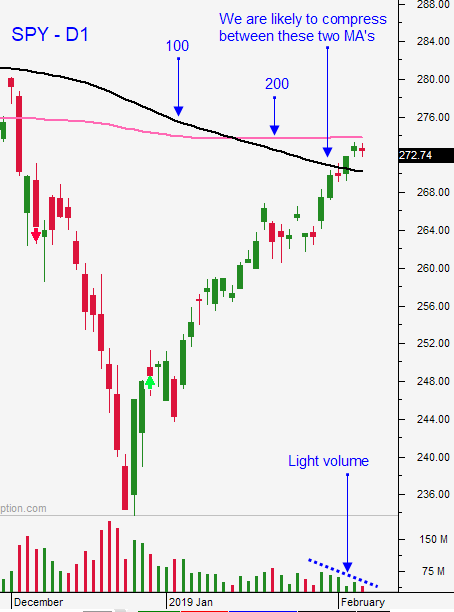

The market rebounded from deeply oversold conditions and the bounce is over-extended. I believe the next big move is down and swing traders should be short. We will use a very wide stop of $277 on a closing basis. The economic undertow will get stronger each week and if any of the positive developments (China trade talks, Brexit deal, Fed's dovish tone and US economic growth) falter the market will drop quickly. Shorts should be prepared to take a little heat along the way. The momentum is strong and it will take time for the bid to soften. Once the 200-day MA falls we should take out the 100-day MA soon after that.

Day traders need to be cautious on the open. This continuing resolution rally feels very vulnerable. I will be looking for an opportunity to get short if the gains start to slip. Watch out for Trump's press conference at 10:00 AM ET. After the first hour of trading you can lean on the 200-day moving average. As long as we are above it, buy dips. Make your money early. The range has been compressing later in the day and the opportunities are few and far between.

I am seeing signs of exhaustion and the selling pressure will build. Watch for late day selling and follow through the next morning.

.

.

Daily Bulletin Continues...