FOMC and Quad Witching Will Spark A Big One-day Move

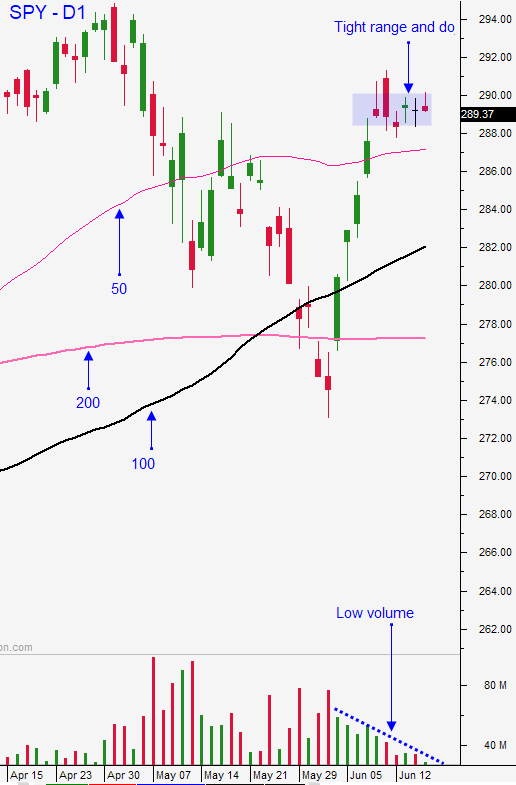

Posted 9:30 AM ET - The market has closed where it opened five of the last six trading days. Trading volume is low and we are trapped in a range. The FOMC statement tomorrow should be a catalyst in one direction or the other.

Dovish comments from the ECB are fueling a rally this morning and the S&P 500 is up 18 points before the open. Interest rates in Europe are at 0% and the central bank is out of monetary bullets. Postponing future rate hikes is all they can do.

The reaction to the FOMC statement tomorrow will revolve around the word "patient". If it is in the statement traders will view it as hawkish. This would mean that the Fed is not ready to cut rates in July. Bond prices imply that three rate hikes are expected this year. One popular bond analyst (Grant) thinks that there will be a rate cut tomorrow, but most experts feel that the expectations are way too high and that the comments will be viewed as hawkish. Most traders will wait for the news and that is contributing to the light trading volume.

I mentioned Monday that there must be some evidence that Xi will not attend the G20 summit since Trump and his economic advisor (Kudlow) have both referenced it recently. This morning the Wall Street Journal reported that a White House official put the odds of the meeting at 50/50. A no-show would end the negotiations and a full-blown tit-for-tat trade war would evolve.

Xi is visiting North Korea and some analysts believe that China is going to deliver a nuclear agreement to Trump during the G20 meeting as a peace offering. I've been saying for many months that China is using North Korea as a pawn in the trade negotiations. Unfortunately, I don't believe this is going to happen. There could be some incremental steps in that direction, but China plans to use this leverage for a long time. If there is decent progres, the US will cancel an order to sell $3 billion worth of weapons to Taiwan.

Both countries are moving all of the chess pieces. Xi said that many development projects are planned with Iran and this defies US sanctions.

It would be foolish for Trump to think that the US holds all of the trade negotiation cards because it accounts for 25% of the world's consumption. China will remind him that there are many geopolitical considerations as well.

I am pessimistic about the FOMC statement and about a US/China trade agreement. I am going to wait for the news and I will follow the momentum. Once a direction is established it is likely to continue. This is a quadruple witch and we can expect a big trend day this week.

Swing traders should remain short and they should use the all-time high as a stop on a closing basis. This is a long term position. The market is trapped in a tight range and we should get some movement in the next few days. The G20 meeting next week will be critical.

Day traders should look for an opportunity to short the opening rally this morning. Wait for the momentum to stall. Dovish ECB comments mean little when interest rates are already at 0% (and negative in some instances). Europe's economic activity is decelerating and there's nothing the central bank can do to stop it. Once the bid has been tested the market will fall into a tight trading range and we will be "dead till the Fed". Keep your size small after the initial move this morning and fade the extremes.

Two big events (the Fed and the G20) meeting) will determine market direction.

.

.

Daily Bulletin Continues...