Dead Till the Fed – Low Volume and Tight Ranges For 2 Days

Posted 9:30 AM ET - Last week I mentioned that the bounce would stall and that the market would fall into a tight trading range. Four out of the last five days have been dojis (opening price equals closing price). The trading volume is light and this pattern will continue. Wednesday the FOMC statement will be released and traders will not place any big bets before that news.

The market is pricing in two rate cuts in 2019 and I believe that is overly optimistic. We can expect dovish comments this week, but we won't see a rate cut until September (at earliest).

Trade tensions with China are running high. Manufacturers are moving production out of the country in anticipation of new tariffs. China is hankering down for a prolonged battle and we will not see a deal before the 2020 election. They will try to prop up their economy through fiscal spending and monetary easing. Protests in Hong Kong are starting to wane. Trump and Kudlow (economic advisor) have referenced the possibility that Xi might not attend the G20 meeting in two weeks. A “no show” would signal the end of trade negotiations. Last week Xi said that China has many development projects planned with Iran and that defies US sanctions.

Middle East tension is high and oil tankers are being attacked in the Strait of Hormuz. US Naval involvement is likely. Surveillance shows Iranian cruisers removing an unexploded torpedo from one of the tanker hulls and there is little question that Iran is involved.

India is going to raise tariffs on US goods in retaliation of tariffs placed on their steel and aluminum.

Global economic conditions are deteriorating. Europe and Japan are particularly weak. GDP in both regions will be lucky to hit .5% growth this year. Japan plans to increase its consumption tax from 8% to 10% in October.

Broadcom warned that revenues would be down 10% this year due to the tariff war with China and due to the US blacklisting of Huawei. Stocks are trading near the upper end of their valuation range and future warnings will spark profit-taking. We are a few weeks away from Q2 earnings season.

This is a "quadruple witch" and we can expect a big move one day this week. Watch for a trend day where the directional movement is strong. Some of the indexes also rebalance in the next 2 weeks so we have to watch for those announcements.

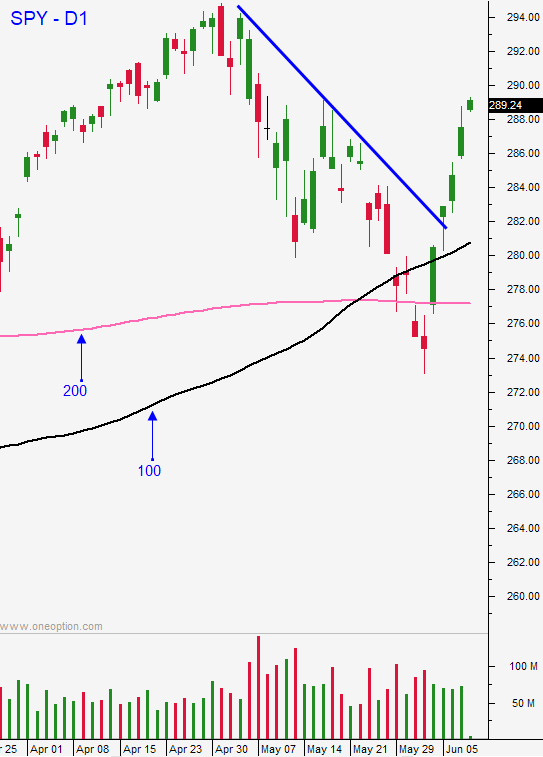

Swing traders are short and we will hold with a closing stop at the all-time high. The bounce was strong, but it has lost its momentum. Stocks will trade in a range and we will see the next leg lower in the next few weeks. I'm expecting a retest of the 200-day MA.

Day traders should expect dull trading until the FOMC statement. Once the first hour range is established, fade the extremes.

I'm not expecting any surprises, but they would favor the downside.

.

.

Daily Bulletin Continues...