Here’s How To Trade the FOMC Statement Today

Posted 9:30 AM ET - With quadruple witching approaching we knew we were going to have one big trading day this week. Depending on the FOMC today, it could have been yesterday. Stocks shot higher on dovish remarks from the ECB and Trump fueled the move when he said that he was meeting with Xi at the G20 meeting. The S&P 500 is within striking distance of the all-time high and today's FOMC statement will be critical.

The ECB will reinstate its bond purchase program. This is the only form of easing they have left and it was not very effective previously. Interest rates are already at 0% (negative in many countries) and the ECB is out of monetary bullets. Economic conditions continue to deteriorate and this is an act of desperation on the part of the ECB. Germany (largest economy in Europe) slashed its GDP forecast for 2019 and it now expects .5% growth this year.

Trump tweeted that he and Xi will meet at the G20 conference in two weeks and that the conversation went well. The news hit the wires 10 minutes after the open and that was a timely release. I was looking to short the open and fortunately I was still evaluating the action. Many traders fade opening gaps higher and this one felt particularly "frothy" given the ECB's lack of firepower. Once the shorts were established traders had to scramble to cover positions and the market shot higher. Throughout the course of the day the gains from the tweet evaporated.

A White House official said that a meeting between Trump and Xi was a 50/50 proposition so this was market friendly news. However, it doesn't mean that a trade deal is close. Both sides have been moving farther and farther apart in recent months. Trade officials will meet this week and next week ahead of the G20 meeting and that will keep buyers engaged.

I don't believe a deal will be struck before the 2020 election. This would increase Trump's reelection odds and China does not want the US to have a strong leader. For decades China has taken advantage of weak leadership (both Republican and Democrat) and Trump is the first one to stand up to them. China views itself as the global leader and they are preparing for a prolonged battle. Xi does not have to worry about reelection and he will "hanker down" until 2024 if he has to. Trump has branded himself as the master negotiator and he has proven that he is willing to walk away from the deal. Xi will avoid looking weak and he will not sign a deal.

Actions speak louder than words. China has initiated fiscal and monetary stimulus to weather the storm. They are using North Korea and Iran as political weapons. North Korea is launching missiles and Iran is attacking oil tankers. Do you think the timing is coincidence? The US has blacklisted Huawei (China’s largest cell phone maker), increase tariffs and we are prepared to sell $3 billion worth of weapons to Taiwan. Both countries are flexing their muscles and they are moving farther apart.

This morning Apple announced that they will move 15 to 30% of their production out of China. Many other firms have done similar. I believe that Apple could come under fire if the Huawei blacklisting continues. China will want to strike back at one of our tech leaders. Apple manufactures cell phones so it is in direct competition with Huawei. China could impose hefty tariffs on iPhones and Apple gets a significant 15 to 20% of its revenue from China.

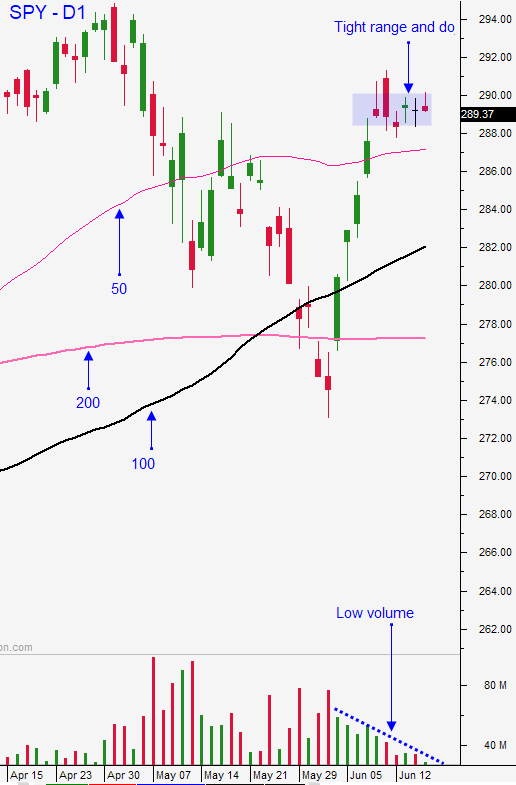

The FOMC meeting today will be very important. If the Fed points to a rate cut in July the market will make a new all-time high. If the word "patient" is removed from the statement this would be a sign that they are ready to cut. If the Fed signals a rate cut in September the market will have a muted reaction. The economic "dots" will reveal this timeline. If the Fed remains neutral and patient, the market will drop to the 200-day moving average in the next few weeks. Easy money and a possible trade deal with China are keeping buyers engaged. I believe that the Fed will hint at a September rate cut if the "dots" deteriorate during the July 31 FOMC meeting. They were very hawkish in December and it would be incredible for them to flip to dovish in just six months. The market has priced 3 rate cuts in this year and that is overly optimistic. I feel that any surprise favors the downside.

Swing traders should stay short and they should use the all-time high as a stop on a closing basis. The market is pricing in the best possible outcomes in the next two weeks.

Day traders should wait until the FOMC statement. Trading ranges have been very compressed intraday and the volume has been low. This morning the S&P futures are flat. We will look for stocks with relative strength/weakness in the chat room and we will keep our trading very light. Once the FOMC statement has been released, wait 15 minutes and follow the momentum. If we get a big move (either way) quadruple witching will fuel the move.

We've been in the summer doldrums for the last week and we will finally get some action later today.

.

.

Daily Bulletin Continues...