The Bid Will Be Tested Before the Market Can Move Higher

Posted 9:30 AM ET - Yesterday the market dropped more than 25 S&P 500 points after Fed speak. The market has closed on its low four days in a row and the S&P 500 has shed 60 points from its all-time high Thursday. The breakout was all "fluff" and the move was fueled by quadruple witching. Traders will wait patiently for news this weekend and the action will be light the rest of the week.

Stocks are poised to bounce this morning after Micron posted better-than-expected results. It is still shipping to Huawei and the blacklisted company has been given a short reprieve to find alternative suppliers. Semiconductor stocks should have a good day today, but the bounce will be temporary. Huawei restrictions will be back in place in a few months and this was a gesture of good faith by the US to keep trade negotiations from breaking down before the G20 meeting.

Jerome Powell said that the Fed has room to shoulder political uncertainties. That means that they don't feel pressured to cut rates if a trade deal with China is not reached. Another Fed official (Bullard) said that a 50 basis point rate cut in July is very unlikely. He is the most dovish of the Fed officials and the market did not like the news. The market rallied last week after the Fed removed the word "patient" from its statement. Traders automatically assumed that a July rate cut was given. Bond prices reflect three rate cuts in 2019 and I believe that is overly optimistic. The Fed is driven by market performance and they will not be that dovish unless the market drops.

Treasury Secretary Mnuchin said that 90% of the trade agreement has been completed and that he feels a deal is close. That is also fueling a small rally this morning. We heard similar language three months ago - then China revamped the agreement. I believe that both sides are miles apart. A couple of weeks ago we didn’t know if a G20 meeting between Trump and Xi would even happen. This is a binary event and we will know the outcome over the weekend.

China will post its official PMI Monday morning and it will also be important. China's economic growth has been slipping and fiscal/monetary stimulus has not stemmed the tide. A weak number might not spark a selloff because traders will assume that additional stimulus is forthcoming. I would argue that "the kitchen sink" has been thrown at China's economy in the last year and it has not stopped the bleeding. Many tech firms from many countries are moving their production out of China due to unfair trade practices and intellectual property theft.

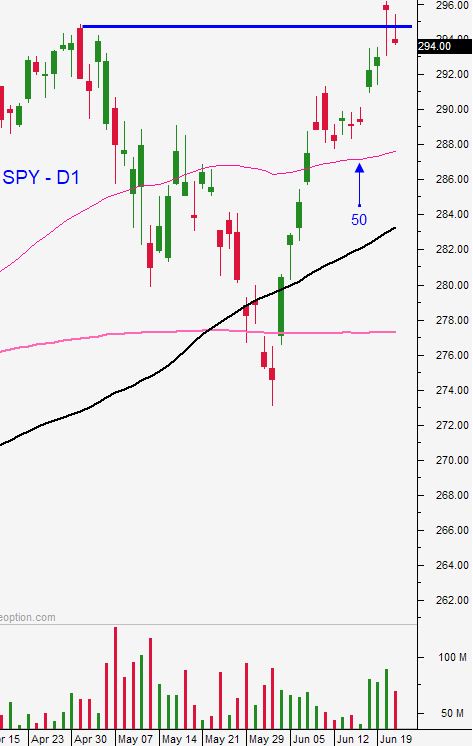

I suspected that last week's rally to a new all-time high was driven by quadruple witching and now those gains have vaporized. The market is below the breakout and resistance is at SPY $295. Support is at $288 and I expect directionless trading the next few days.

Swing traders should stay in cash. The G20 meeting will determine market direction next week. I'm not interested in the comments afterwards. I will be watching the timeline for future trade meetings. Tight scheduling would be a positive sign. Domestic economic releases will also be important next week (ISM manufacturing, ISM services, ADP and the Unemployment Report). The market direction for July will be determined next week.

Day traders should look for opportunities to short the opening rally. The market will not move higher until the bid is tested. We have seen heavy selling pressure the last four days and buyers will make sure that support is in place before they take new positions. Opening gaps higher are often faded and I believe there will be early selling pressure. Once support is established the market will fall into a trading range and you can fade the extremes.

Look for choppy trading the rest of the week. Keep your size small and your trade count low.

.

.

Daily Bulletin Continues...