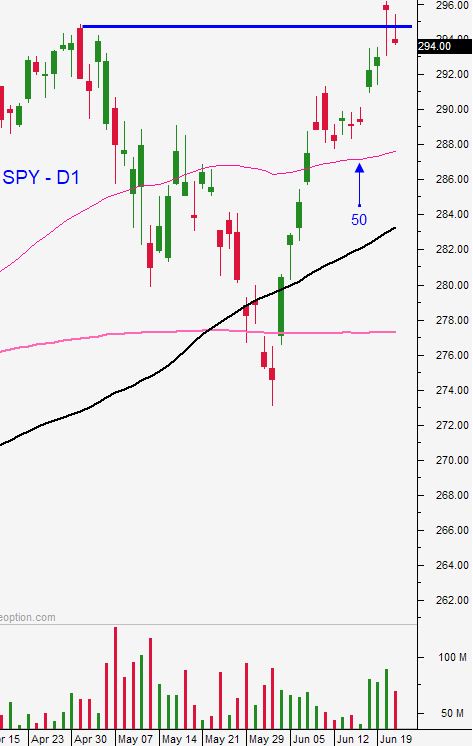

5 Consecutive Days of Selling Since All-time High

Posted 9:30 AM ET - The S&P 500 has declined five straight days since making a new all-time high. Late day selling with follow through the next day is a bearish pattern. The breakout above SPY $295 has failed and the quadruple witching "sugar high" has vanished. Traders are anxiously waiting for news from the G20 meeting this weekend.

The Wall Street Journal reports that China has a list of preconditions before trade negotiations can resume. Beijing wants the blacklisting of Huawei removed, they want all punitive tariffs to be lifted and they want the US to drop its export quotas to China. I don't believe that Trump will drop existing tariffs. He has already given Huawei a few months to develop new supply lines in good faith so that trade negotiations can continue. He might have some flexibility on US export quotas to China, but not the other two. I don't believe a trade agreement will be reached before the 2020 election.

China's PMI will be posted Monday morning and we will get a feel for their economic growth.

Fed speak this week has not been hawkish, but officials did not provide a timetable for rate cuts. The market is pricing in three moves this year and that is overly optimistic. We won’t get three rate cuts without a big market decline.

Swing traders should remain sidelined. We were stopped out of our short position during the quadruple witching "sugar high" last week. The G20 meeting is a binary event and we will wait for the dust to settle. The schedule for future trade negotiations will be critical. If the meetings are frequent and timely we will know that progress is being made.

Day traders should look for early selling. The bid will be tested just as it has been the last five days. Once support is established you can't fade the extremes. Keep your size small and your trade count low.

The G20 meeting and major economic releases next week will determine market direction for the month of July.

.

.

Daily Bulletin Continues...