Market Will Be Dull Today – Watch For This News At 11 AM ET

Posted 9:30 AM ET - The market surged to a new all-time high last week and this feels like a "sugar high". Trump and Xi will meet Saturday, but the tenor is sour and there was a chance that the meeting might not have happened. The Fed made dovish remarks, but no timeline for a rate cut was provided. With the market at an all-time high they will not ease until the market drops. Quadruple witching fueled the rally and the move lacks substance. All eyes are focused on the G20 meeting.

I don't want to rehash what I've already written, but I've given you all of my reasons for skepticism. I don't believe a trade deal will happen before the 2020 election. I have been saying this since the beginning of the year and I am out on a limb. China already views itself as the global leader and it will not back down to anyone. They are preparing for a prolonged battle and I have outlined the actions that support that theory.

China's exports to the US have declined dramatically and that is only part of the story. Other nations like South Korea and Japan have also decreased imports from China in response to unfair trade practices. China will post its official PMI Monday morning and that will be a big news event.

The Fed Chairman will testify before Congress at 11 AM Eastern time this morning. I doubt that he will shed any new light. His post FOMC press conference addressed all of the major questions. He will not provide a specific timeline for the next rate cut and that is all the market really cares about. Three rate cuts are priced in for 2019 and I believe that is overly optimistic.

Durable goods orders and GDP will be posted this week. I don't believe either will move the market.

Earnings season will start in a couple of weeks and we could see some earnings warnings (i.e BRCM). Stocks are priced at the upper end of their valuation range (forward P/E of 17) and there is room for profit-taking.

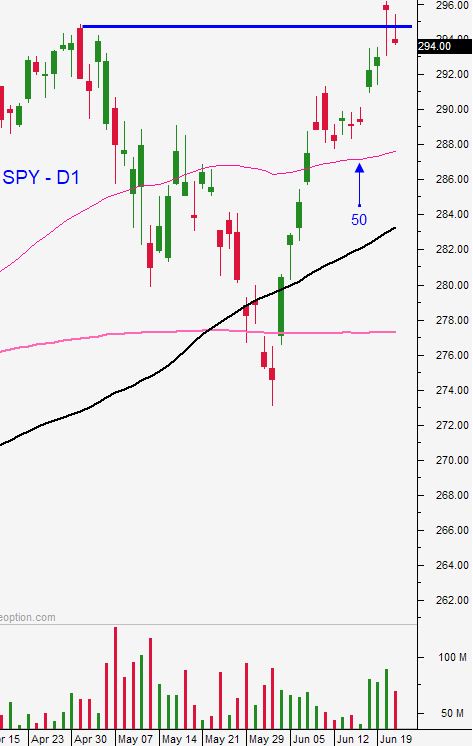

Swing traders should remain in cash. Since the breakout last week the market has not been able to advance. It is addicted to loose monetary policy and it needs a trade deal with China to advance.

Day traders should use caution. The trading range yesterday was very compressed and we can expect similar today. Monday will be critical and I believe it will set the direction for the month of July.

We are in a holding pattern for the rest of the week and the summer doldrums will set in.

.

.

Daily Bulletin Continues...