The Calm Before the Storm – Big News This Weekend Will Determine Market Direction

Posted 9:30 AM ET - The market is completely driven by news these days. One event passes and the action dies down until the next release. This is true whether it is a trade related meeting, the FOMC, economic news, continuing resolution, Brexit or other. We are in a holding pattern and traders will take their cue from the G20 meeting this weekend.

The rhetoric between China and the US has been heated and the meeting was in question a few weeks ago. China revised key terms that had been agreed upon a number of weeks ago and the US responded with new tariffs and a blacklisting of China’s largest telecom (Huawei). China will use political leverage during the negotiations (North Korea and Iran).

Unless the US completely backs down (I outlined China’s demands yesterday) a trade deal will not happen before the 2020 election. This is not Trump's style and he preaches that you need to be willing to walk away. He is the first president in decades to challenge China and Xi will not facilitate his reelection.

It is likely that trade negotiations will resume, but I will be looking for tightly scheduled meetings. That would be a positive sign and the market would rally on this news. Unfortunately, the talks will eventually break down.

Major companies have been shifting manufacturing out of China for years and the departures are escalating. US tariffs, patent infringement and cheaper labor are to blame. China is feeling the heat and despite massive stimulus (fiscal and monetary) their economy continues to slip.

The Fed is closely monitoring political uncertainty and it said that it has plenty of room to shoulder temporary events. This means they are not going to hit the panic button at the first sign of trouble and the market did not like that response. Fed official Bullard is the biggest dove and he said that a 50 basis point rate cut is not needed at this time. The market sold off on that remark because it wants a rate cut in July (unlikely). Bonds have priced in three rate hikes this year and that won't happen without a major market decline.

Earnings season is approaching and that typically attracts buyers. Stock valuations are at the upper end of their range (forward P/E of 17) and there is room for profit-taking. Pre-earnings warnings will be critical the next two weeks.

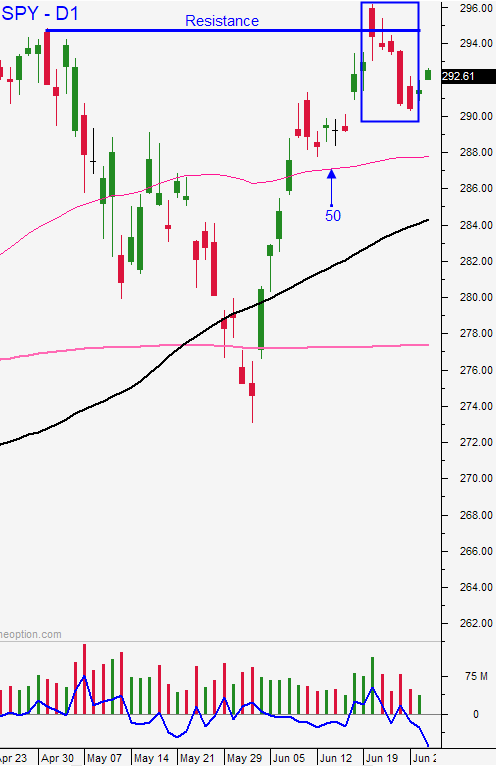

Swing traders should remain in cash. I don't sense any urgency to get long. Since making a new all-time high the next five trading days closed lower. If the G20 meeting goes well and the market breaks out to a new all-time high we can join the party. If the G20 meeting does not go well I am prepared to short the market when it breaches the 50-day moving average. This is a binary event and cash is king.

Day traders should take a balanced approach. Yesterday stocks closed higher for the first time in a week and the price action this morning is bullish before the open. I am favoring the long side today. Any "tweets" will be bullish heading into the meeting and the risk of a spike is high. I expect a trading range today and I will be buying stocks with relative strength.

Monday should be an exciting trading day.

.

.

Daily Bulletin Continues...