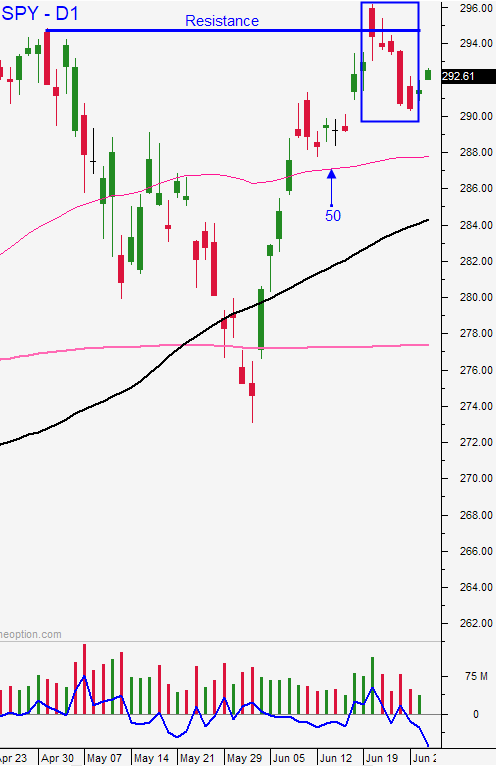

Use the All-time High As Your Guide – A 2nd Failed Breakout Would Be Bearish

Posted 9:30 AM ET - This morning the S&P 500 is up 35 points before the open. Trump and Xi called a cease-fire after their G20 meeting. Both sides are no closer to a trade deal, but at least they agreed to continue negotiations. Official manufacturing PMI's around the globe were very weak. The S&P 500 will challenge the all-time high this morning.

China and the US are still miles apart from a trade deal. The US lifted some restrictions on Huawei and it sounds like components that don't pose a security threat can be shipped to the company. In December the market rallied into the G20 meeting in Argentina on the hopes that trade relations with China would improve. After that meeting the market gradually started to move lower when there was no progress. I believe the same could happen this time.

China's manufacturing PMI came in at 49.4 (slightly lower than expected). Europe's manufacturing PMI was a dismal 47.6, Japan's reading was 49.3, South Korea was 47.5, Taiwan was 45.5. Global economic conditions continue to slip.

Watch the ISM manufacturing number 30 minutes after the open today.

Trump's visit to North Korea is nothing more than a photo op. It really doesn't change our relations.

I mentioned last week that we should hear positive comments from the G20 meeting, but no results. Xi will drag this on as long as possible and eventually it will become apparent that China has no intentions of signing a trade deal before the 2020 election. For now, the market likes the news.

Swing traders should remain in cash. There was no incremental news and we need to see if this second breakout will hold. Another failure will solidify resistance at the all-time high. Earnings season is upon us and that typically attracts buyers.

Day traders should watch to see if the move higher gains traction. I will be looking for a shorting opportunity on the open. I don't believe we will blow through the all-time high on this news. The bid will be checked and the retracement will reveal the strength of the rally. If the dip is small and brief, cover your shorts and trade from the long side. If the retracement is slow and steady, favor the short side. Opening gaps higher have a tendency to reverse and we saw five consecutive days of selling after the new high was established two weeks ago. Use the all-time high as your guide.

There wasn't any incremental news to justify the rally. It wasn't bad news and it wasn't good news. Buyers are looking for a reason to get long ahead of earnings season and the G20 meeting provided that.

The momentum today will fade quickly as we go into pre-holiday mode. There are many domestic economic releases this week.

I am sorry to report that my sister in-law is likely to pass in the next day or two from pancreatic cancer leaving my young niece and nephew parentless. My brother in-law died 10 years ago from melanoma. Medical expenses have completely drained the family financially. This is an incredibly painful period in our lives and I will be taking time off to help them. I will not be posting comments the rest of the week and I will be taking additional time off in the future. Thank you for your prayers.

.

.

Daily Bulletin Continues...