Important Number After the Open – It Will Impact the Market – Wait For It

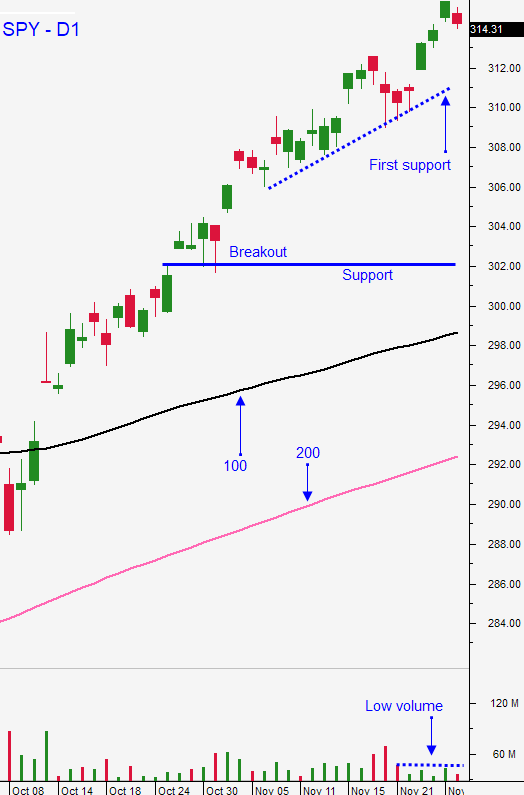

Posted 9:30 AM ET - The market has been soft this week due to rising concerns that a trade truce with China will not happen. Those fears have subsided slightly overnight on a report from Bloomberg that negotiators are hammering out the details. After testing minor support at SPY $307 the market bounced late in the day forming a bullish hammer. This morning we will try to fill-in the gap from Tuesday. The calendar is pretty heavy the next 10 days.

I still don't believe that a trade truce with China will happen. Trump just signed a bill supporting pro-democracy protesters in Hong Kong and another bill supporting Turkic Muslims will be forthcoming. This will not sit well with China and the talks will stall. Neither side is very motivated. Economic growth is stable in both countries (even with the tariffs) and both countries are raking in billions in tax revenues. I'm hoping that the market pulls back on the news because it will provide us with an opportunity to sell bullish put spreads.

Democrats could be forced to sign the USMCA. They are losing favor with voters because of the impeachment hearings and Americans want them to focus on important topics like health care, infrastructure and economic growth. The USMCA could boost GDP by 1% next year. Mexico is ready to sign and Canada is simply waiting for the US to sign the agreement. This trade deal dwarfs the trade truce with China since we export four times as much to our neighbors.

China's Caixin services PMI came in at 53.5. That was much better than the 51.2 that was expected.

ISM manufacturing in the US came in at 48.1. That was a very soft reading and ISM services will be posted 30 minutes after the open today. The service sector accounts for 80% of our economic activity so it is much more important. This morning ADP reported that 67,000 new jobs were created in the private sector during the month of November. That is much lower than the 175,000 that were expected. ADP processes payrolls for small and medium-size businesses and I trust their number. This is a pretty big miss.

Next week the FOMC statement will be released. Provided that economic growth is stable the Fed will maintain its current policy.

A week from tomorrow England will hold a vote and if Boris Johnson gains seats as expected a Brexit deal could happen quickly. This will remove market uncertainty.

Swing traders should place an intraday stop on VXX at 17.50 after ISM services comes out (10 AM ET). A weak number would spark selling especially after a soft ISM manufacturing number and a soft ADP number. I don't want to lose money on this trade. We missed buying a quarter of a position on SPY yesterday at $307 by a few pennies. The market bid is still strong and this dip might be all we get. I will be looking for bullish put spreads in my weekly swing trading video tonight. I will use Option Stalker to find stocks with relative strength and strong technical support. The selling pressure the last two days will make them fairly easy to find. We will hold off on having a standing order to buy SPY today. If we had purchased a 1/4 position yesterday I would be advising you to take a $4 profit this morning.

Day traders should wait to see if the early gains this morning hold. I don't plan on taking any positions before the ISM services number. We should see a little selling this morning and the bid will be tested. Provided that ISM services is decent and support is established, I will focus on the long side. If the bid crumbles quickly after the number I will favor the short side. Stay fluid with your day trading and follow the momentum. Support is at SPY $310 and $307.

We've seen some profit-taking this week and resistance is starting to form. At a forward P/E of 17.5, stocks are a little pricey. Be patient and let's see if we get that dip.

.

.

Daily Bulletin Continues...