Here’s What We Learned From the Market Dip – Use This Option Strategy

Posted 9:30 AM ET - Monday the market gapped down on news that the US/China trade truce might be in jeopardy. Tuesday we saw follow-through selling on the open and a reversal during the day. Buyers scooped that dip and we learned that the bid is still strong. As long as the USMCA is signed the market won't care about a China trade truce. Start selling out of the money bullish put spreads.

Trade negotiations with China are ongoing and we keep hearing about progress. Most analysts believe that there will be an agreement before the December 15th when new tariffs are scheduled to go into effect. In reality, there is no deadline and the new tariffs can be postponed indefinitely. I believe that both sides are simply providing lip service to investors. As long as they stay at the negotiating table the market will be content.

China has reiterated that it wants all tariffs removed before they consider a truce. Trump will never agree to this and it would be a sign of weakness. His anti-China stance is gaining traction with voters and he has no incentive to strike a deal. US economic growth is strong, consumers are not paying higher prices (due to China's currency devaluation) and the government is raking in billions of dollars in tax revenues from the tariffs. Meanwhile, China's food prices are skyrocketing because of the US agricultural boycott.

Democrats are losing face with voters and according to polls the impeachment hearings are a flop. Americans want Congress to focus on economic growth, healthcare and infrastructure. Nancy Pelosi is feeling the pressure and she said that Democrats are close to signing the USMCA. This deal could add 1% to GDP growth next year.

England will hold elections on December 12th and Boris Johnson should gain support. This would solidify a Brexit agreement and it would remove market uncertainty.

The FOMC statement will be released next week and the Fed is content with current policy. I am not expecting any surprises.

Domestic economic conditions are stable. ISM manufacturing was light (48.1) and ISM services missed expectations but the overall level is still strong (53.9). ADP reported that 67,000 new jobs were created in the private sector during the month of November and that was a considerable miss. One number does not make a trend and I'll be watching the employment statistics when the Unemployment Report is posted tomorrow.

Stocks are trading at a forward P/E of 17.5 and that is a bit rich. Asset Managers are not going to rush in and buy stocks at this level so we should expect an orderly grind higher.

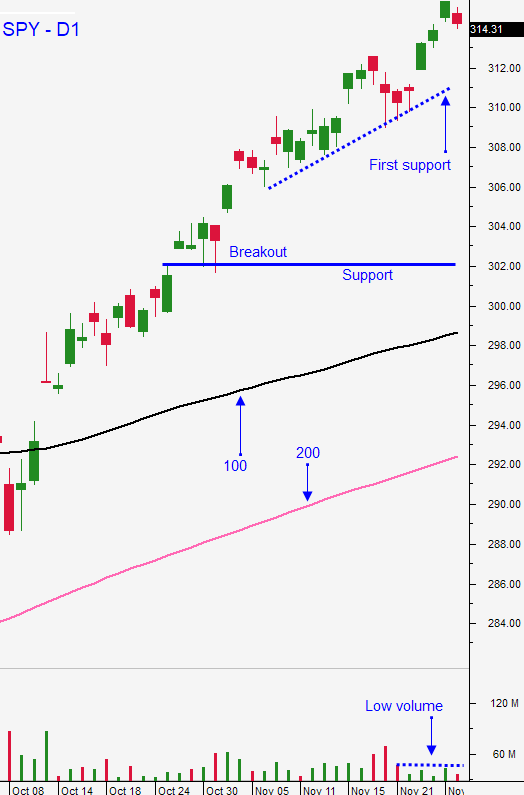

The only potential speed bump is a breakdown in US/China trade negotiations. Congress is rushing to vote on a bill that supports Muslims in China and Trump will sign it just like he signed the bill supporting pro-democracy protesters in Hong Kong. This will be the second slap in the face and China will retaliate. I am less worried about them walking away from a trade truce than I was a week ago. Every market decline related to a trade war with China has been smaller during the course of the last year. The drop we saw this week was barely a blip on the radar. I was hoping that bullish speculators would be shaken out and that the selling would last a few more days, but it didn't. This price action tells me that the bid is still strong.

Swing traders should start selling out of the money bullish put spreads. Last night I posted my swing trading video and I used Option Stalker searches to find these opportunities. Heavy volume, relative strength and strong technical support are the keys to a good trade. The strike price for the short put should be below technical support. If that support is breached, buy back the spread. Passive swing traders can hedge the position by being long VXX. I don't believe that option premiums will decline much further and the VXX will tread water. If we do get a market decline VXX will spike like it did this week and it will offset any potential losses on your bullish put spreads. Stocks with relative strength will weather the storm and you will have time to evaluate the positions if the market does drop. Personally, I don't feel the need for a hedge. I am going to allocate half of my target position this week and I believe we will see a nice grind higher through year-end. I will leave some dry power in case we get another dip.

CLICK HERE TO GET MY SWING TRADING PICKS. SUBSCRIBE TO THIS YOUTUBE CHANNEL AND NEVER MISS A TRADE.

Day traders need to find opportunities early in the day. The market has had a tendency to make big moves on the open and to stall the rest of the day. In the chat room we have been able to find stocks with momentum. Heavy volume is the key and I suggest searching for stocks with a volume spike in the last 15 minutes using Option Stalker.

Look for steady price action with an upward bias through year-end.

.

.

Daily Bulletin Continues...